Code

library(tidyverse)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)Tejaswini_Ketineni

August 21, 2022

Homework 2

For this homework, your goal is to read in a more complicated dataset. Please use the category tag “hw2” as well as a tag for the dataset you choose to use. Read in a dataset from the _data folder in the course blog repository, or choose your own data. If you decide to use one of the datasets we have provided, please use a challenging dataset - check with us if you are not sure. Clean the data as needed using dplyr and related tidyverse packages. Provide a narrative about the data set (look it up if you aren’t sure what you have got) and the variables in your dataset, including what type of data each variable is. The goal of this step is to communicate in a visually appealing way to non-experts - not to replicate r-code. Identify potential research questions that your data set can help answer.

The dataset that I have chosen to work is FedFunds data set which gives insights about the economics, inflation etc..,

we initially read the Fed funds data that is already present in the data folder

while we initially see the data, we see that there are a lot of NA’ s in the data in the initial glance. But to understand more about the data, we need to further analyse it.

Extracting the column names

[1] "Year" "Month"

[3] "Day" "Federal Funds Target Rate"

[5] "Federal Funds Upper Target" "Federal Funds Lower Target"

[7] "Effective Federal Funds Rate" "Real GDP (Percent Change)"

[9] "Unemployment Rate" "Inflation Rate" Getting the size of the data

We see that there about 904 rows and 10 columns in the dataset

let’s visualize the sample data

# A tibble: 6 × 10

Year Month Day Federal Fu…¹ Feder…² Feder…³ Effec…⁴ Real …⁵ Unemp…⁶ Infla…⁷

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1954 7 1 NA NA NA 0.8 4.6 5.8 NA

2 1954 8 1 NA NA NA 1.22 NA 6 NA

3 1954 9 1 NA NA NA 1.06 NA 6.1 NA

4 1954 10 1 NA NA NA 0.85 8 5.7 NA

5 1954 11 1 NA NA NA 0.83 NA 5.3 NA

6 1954 12 1 NA NA NA 1.28 NA 5 NA

# … with abbreviated variable names ¹`Federal Funds Target Rate`,

# ²`Federal Funds Upper Target`, ³`Federal Funds Lower Target`,

# ⁴`Effective Federal Funds Rate`, ⁵`Real GDP (Percent Change)`,

# ⁶`Unemployment Rate`, ⁷`Inflation Rate`let’s get the summary of the data in the firstplace to clean the data.

Year Month Day Federal Funds Target Rate

Min. :1954 Min. : 1.000 Min. : 1.000 Min. : 1.000

1st Qu.:1973 1st Qu.: 4.000 1st Qu.: 1.000 1st Qu.: 3.750

Median :1988 Median : 7.000 Median : 1.000 Median : 5.500

Mean :1987 Mean : 6.598 Mean : 3.598 Mean : 5.658

3rd Qu.:2001 3rd Qu.:10.000 3rd Qu.: 1.000 3rd Qu.: 7.750

Max. :2017 Max. :12.000 Max. :31.000 Max. :11.500

NA's :442

Federal Funds Upper Target Federal Funds Lower Target

Min. :0.2500 Min. :0.0000

1st Qu.:0.2500 1st Qu.:0.0000

Median :0.2500 Median :0.0000

Mean :0.3083 Mean :0.0583

3rd Qu.:0.2500 3rd Qu.:0.0000

Max. :1.0000 Max. :0.7500

NA's :801 NA's :801

Effective Federal Funds Rate Real GDP (Percent Change) Unemployment Rate

Min. : 0.070 Min. :-10.000 Min. : 3.400

1st Qu.: 2.428 1st Qu.: 1.400 1st Qu.: 4.900

Median : 4.700 Median : 3.100 Median : 5.700

Mean : 4.911 Mean : 3.138 Mean : 5.979

3rd Qu.: 6.580 3rd Qu.: 4.875 3rd Qu.: 7.000

Max. :19.100 Max. : 16.500 Max. :10.800

NA's :152 NA's :654 NA's :152

Inflation Rate

Min. : 0.600

1st Qu.: 2.000

Median : 2.800

Mean : 3.733

3rd Qu.: 4.700

Max. :13.600

NA's :194 Looking at the summary we see that there are a lot of NA’s present in the data in almost all the columns except for Year,Month,date.Inorder to clean the data, we must drop all the NA’s present in the data.

# A tibble: 0 × 10

# … with 10 variables: Year <dbl>, Month <dbl>, Day <dbl>,

# Federal Funds Target Rate <dbl>, Federal Funds Upper Target <dbl>,

# Federal Funds Lower Target <dbl>, Effective Federal Funds Rate <dbl>,

# Real GDP (Percent Change) <dbl>, Unemployment Rate <dbl>,

# Inflation Rate <dbl>A new data frame with the name of cleaned_fed_funds is created after dropping all the NA’s.

if we drop all the NA’s then we are getting no rows in the data set.Let’s try an other way of dropping na’s

# A tibble: 0 × 10

# … with 10 variables: Year <dbl>, Month <dbl>, Day <dbl>,

# Federal Funds Target Rate <dbl>, Federal Funds Upper Target <dbl>,

# Federal Funds Lower Target <dbl>, Effective Federal Funds Rate <dbl>,

# Real GDP (Percent Change) <dbl>, Unemployment Rate <dbl>,

# Inflation Rate <dbl>So inorder to retain the dataset, let’s drop NA’s from those of the columns that we would actually like to visualize or consider them important.

# A tibble: 236 × 10

Year Month Day Federal F…¹ Feder…² Feder…³ Effec…⁴ Real …⁵ Unemp…⁶ Infla…⁷

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1958 1 1 NA NA NA 2.72 -10 5.8 3.2

2 1958 4 1 NA NA NA 1.26 2.6 7.4 2.4

3 1958 7 1 NA NA NA 0.68 9.6 7.5 2.4

4 1958 10 1 NA NA NA 1.8 9.7 6.7 1.7

5 1959 1 1 NA NA NA 2.48 7.7 6 1.7

6 1959 4 1 NA NA NA 2.96 10.1 5.2 1.7

7 1959 7 1 NA NA NA 3.47 -0.8 5.1 2

8 1959 10 1 NA NA NA 3.98 1.6 5.7 2.7

9 1960 1 1 NA NA NA 3.99 9.2 5.2 2

10 1960 4 1 NA NA NA 3.92 -1.5 5.2 2

# … with 226 more rows, and abbreviated variable names

# ¹`Federal Funds Target Rate`, ²`Federal Funds Upper Target`,

# ³`Federal Funds Lower Target`, ⁴`Effective Federal Funds Rate`,

# ⁵`Real GDP (Percent Change)`, ⁶`Unemployment Rate`, ⁷`Inflation Rate` Year Month Day Federal Funds Target Rate

Min. :1958 Min. : 1.00 Min. :1 Min. : 1.000

1st Qu.:1972 1st Qu.: 3.25 1st Qu.:1 1st Qu.: 3.750

Median :1987 Median : 5.50 Median :1 Median : 5.250

Mean :1987 Mean : 5.50 Mean :1 Mean : 5.407

3rd Qu.:2002 3rd Qu.: 7.75 3rd Qu.:1 3rd Qu.: 7.000

Max. :2016 Max. :10.00 Max. :1 Max. :11.000

NA's :131

Federal Funds Upper Target Federal Funds Lower Target

Min. :0.2500 Min. :0.00000

1st Qu.:0.2500 1st Qu.:0.00000

Median :0.2500 Median :0.00000

Mean :0.2812 Mean :0.03125

3rd Qu.:0.2500 3rd Qu.:0.00000

Max. :0.5000 Max. :0.25000

NA's :204 NA's :204

Effective Federal Funds Rate Real GDP (Percent Change) Unemployment Rate

Min. : 0.070 Min. :-10.000 Min. : 3.400

1st Qu.: 2.655 1st Qu.: 1.400 1st Qu.: 5.000

Median : 4.845 Median : 3.100 Median : 5.700

Mean : 5.084 Mean : 3.116 Mean : 6.074

3rd Qu.: 6.875 3rd Qu.: 4.800 3rd Qu.: 7.100

Max. :19.080 Max. : 16.500 Max. :10.400

Inflation Rate

Min. : 0.600

1st Qu.: 2.000

Median : 2.800

Mean : 3.740

3rd Qu.: 4.725

Max. :13.000

Rows: 236

Columns: 10

$ Year <dbl> 1958, 1958, 1958, 1958, 1959, 1959, 195…

$ Month <dbl> 1, 4, 7, 10, 1, 4, 7, 10, 1, 4, 7, 10, …

$ Day <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, …

$ `Federal Funds Target Rate` <dbl> NA, NA, NA, NA, NA, NA, NA, NA, NA, NA,…

$ `Federal Funds Upper Target` <dbl> NA, NA, NA, NA, NA, NA, NA, NA, NA, NA,…

$ `Federal Funds Lower Target` <dbl> NA, NA, NA, NA, NA, NA, NA, NA, NA, NA,…

$ `Effective Federal Funds Rate` <dbl> 2.72, 1.26, 0.68, 1.80, 2.48, 2.96, 3.4…

$ `Real GDP (Percent Change)` <dbl> -10.0, 2.6, 9.6, 9.7, 7.7, 10.1, -0.8, …

$ `Unemployment Rate` <dbl> 5.8, 7.4, 7.5, 6.7, 6.0, 5.2, 5.1, 5.7,…

$ `Inflation Rate` <dbl> 3.2, 2.4, 2.4, 1.7, 1.7, 1.7, 2.0, 2.7,…# A tibble: 236 × 10

# Groups: Year [59]

Year Month Day Federal F…¹ Feder…² Feder…³ Effec…⁴ Real …⁵ Unemp…⁶ Infla…⁷

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1958 1 1 NA NA NA 2.72 -10 5.8 3.2

2 1958 4 1 NA NA NA 1.26 2.6 7.4 2.4

3 1958 7 1 NA NA NA 0.68 9.6 7.5 2.4

4 1958 10 1 NA NA NA 1.8 9.7 6.7 1.7

5 1959 1 1 NA NA NA 2.48 7.7 6 1.7

6 1959 4 1 NA NA NA 2.96 10.1 5.2 1.7

7 1959 7 1 NA NA NA 3.47 -0.8 5.1 2

8 1959 10 1 NA NA NA 3.98 1.6 5.7 2.7

9 1960 1 1 NA NA NA 3.99 9.2 5.2 2

10 1960 4 1 NA NA NA 3.92 -1.5 5.2 2

# … with 226 more rows, and abbreviated variable names

# ¹`Federal Funds Target Rate`, ²`Federal Funds Upper Target`,

# ³`Federal Funds Lower Target`, ⁴`Effective Federal Funds Rate`,

# ⁵`Real GDP (Percent Change)`, ⁶`Unemployment Rate`, ⁷`Inflation Rate`

1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973

4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4

1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989

4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

4 4 4 4 4 4 4 4 4 4 4 we see that there are a range of years, from 1958-2016

| Variable | Stats / Values | Freqs (% of Valid) | Graph | Missing | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year [numeric] |

|

59 distinct values | 0 (0.0%) | |||||||||||||||||||||||||||||

| Month [numeric] |

|

|

0 (0.0%) | |||||||||||||||||||||||||||||

| Day [numeric] | 1 distinct value |

|

0 (0.0%) | |||||||||||||||||||||||||||||

| Federal Funds Target Rate [numeric] |

|

42 distinct values | 131 (55.5%) | |||||||||||||||||||||||||||||

| Federal Funds Upper Target [numeric] |

|

2 distinct values | 204 (86.4%) | |||||||||||||||||||||||||||||

| Federal Funds Lower Target [numeric] |

|

2 distinct values | 204 (86.4%) | |||||||||||||||||||||||||||||

| Effective Federal Funds Rate [numeric] |

|

193 distinct values | 0 (0.0%) | |||||||||||||||||||||||||||||

| Real GDP (Percent Change) [numeric] |

|

110 distinct values | 0 (0.0%) | |||||||||||||||||||||||||||||

| Unemployment Rate [numeric] |

|

62 distinct values | 0 (0.0%) | |||||||||||||||||||||||||||||

| Inflation Rate [numeric] |

|

75 distinct values | 0 (0.0%) |

Generated by summarytools 1.0.1 (R version 4.2.1)

2022-12-20

Now we can look at the summary and get few insights from the data regarding the data type of the columns,statistical analysis, frequency of the data etc..,

Understanding year-wise GDP metrics

# A tibble: 59 × 4

# Groups: Year [59]

Year GDP_min GDP_max GDP_mean

<fct> <dbl> <dbl> <dbl>

1 2016 0.8 3.5 1.9

2 2015 0.9 2.6 1.88

3 2014 -1.2 5 2.52

4 2013 0.8 4 2.68

5 2012 0.1 2.7 1.3

6 2011 -1.5 4.6 1.7

7 2010 1.7 3.9 2.7

8 2009 -5.4 3.9 -0.175

9 2008 -8.2 2 -2.7

10 2007 0.2 3.1 1.85

11 2006 0.4 4.9 2.43

12 2005 2.1 4.3 3.02

13 2004 2.3 3.7 3.12

14 2003 2.1 6.9 4.4

15 2002 0.3 3.7 2.05

16 2001 -1.3 2.1 0.2

17 2000 0.5 7.8 2.95

18 1999 3.2 7.1 4.68

19 1998 3.9 6.7 4.97

20 1997 3.1 6.2 4.4

21 1996 2.7 7.2 4.47

22 1995 1.4 3.5 2.3

23 1994 2.4 5.6 4.15

24 1993 0.8 5.4 2.65

25 1992 3.9 4.8 4.32

26 1991 -1.9 3.1 1.23

27 1990 -3.4 4.5 0.7

28 1989 0.9 4.1 2.8

29 1988 2.3 5.4 3.85

30 1987 2.8 6.8 4.47

31 1986 1.9 4.1 2.97

32 1985 3 6.4 4.28

33 1984 3.2 8.2 5.65

34 1983 5.3 9.4 7.82

35 1982 -6.5 2.2 -1.32

36 1981 -4.6 8.5 1.43

37 1980 -7.9 7.6 0.100

38 1979 0.5 2.9 1.3

39 1978 1.4 16.5 6.85

40 1977 0 8.1 5.03

41 1976 2.1 9.3 4.38

42 1975 -4.7 6.8 2.68

43 1974 -3.8 1.1 -1.9

44 1973 -2.2 10.2 4.1

45 1972 3.7 9.6 6.88

46 1971 1.2 11.1 4.45

47 1970 -4 3.6 -0.1

48 1969 -1.7 6.4 2.12

49 1968 1.8 8.4 5

50 1967 0.3 3.7 2.68

51 1966 1.6 10.2 4.55

52 1965 5.6 10.2 8.5

53 1964 1.4 8.9 5.15

54 1963 2.9 8 5.18

55 1962 1.6 7.4 4.32

56 1961 2.7 8.3 6.35

57 1960 -4.8 9.2 0.975

58 1959 -0.8 10.1 4.65

59 1958 -10 9.7 2.97 Lets see how un employement rate is being affected with year

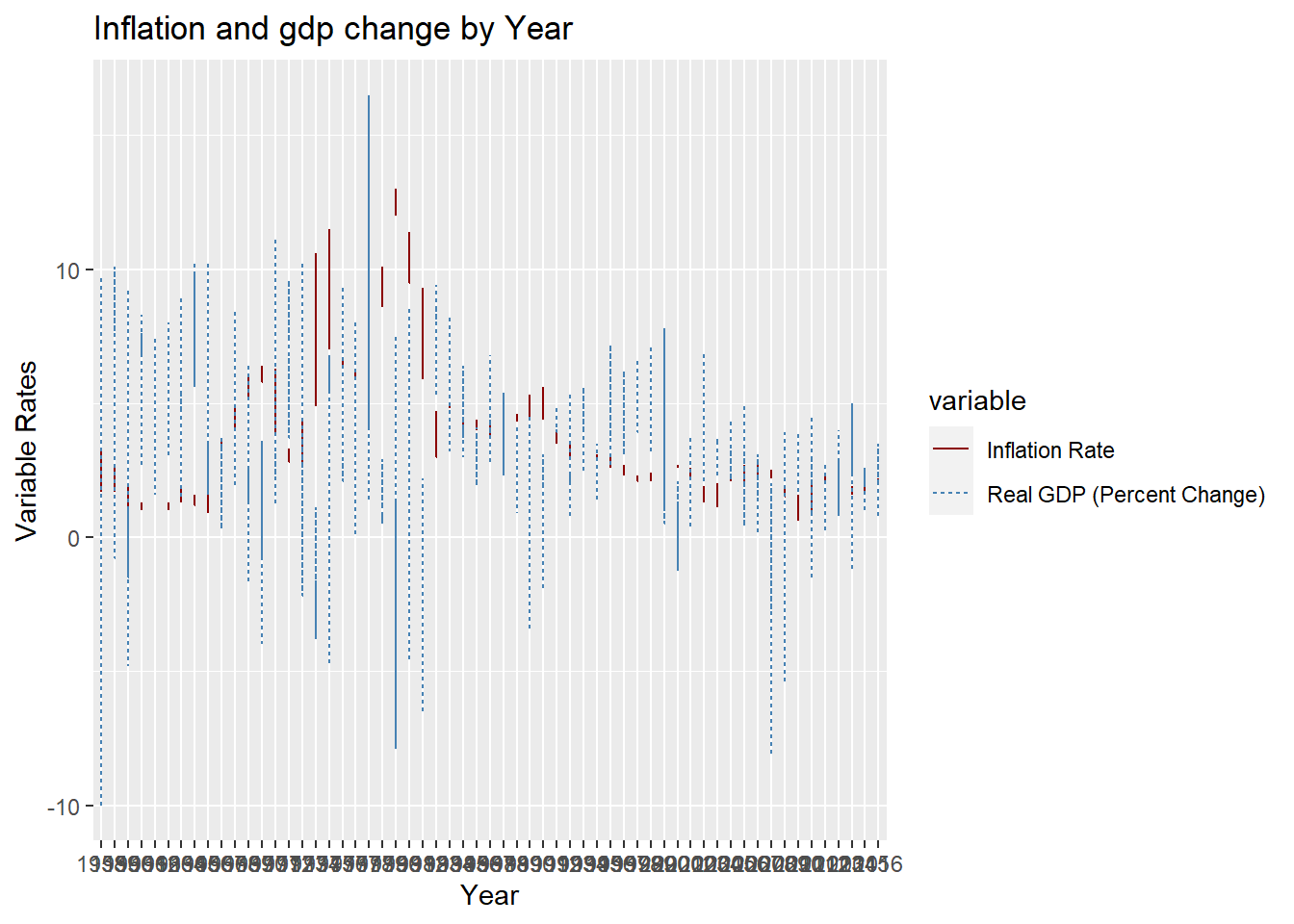

a <- cleaned_fed_funds1 %>%

select(Year, `Real GDP (Percent Change)`, `Inflation Rate`) %>%

gather(key = "variable", value = "value", -Year)

ggplot(a, aes(x =`Year`, y = value)) +

geom_line(aes(color = variable, linetype = variable)) +

scale_color_manual(values = c("darkred", "steelblue"))+labs(

title = "Inflation and gdp change by Year",

y = "Variable Rates", x = "Year")

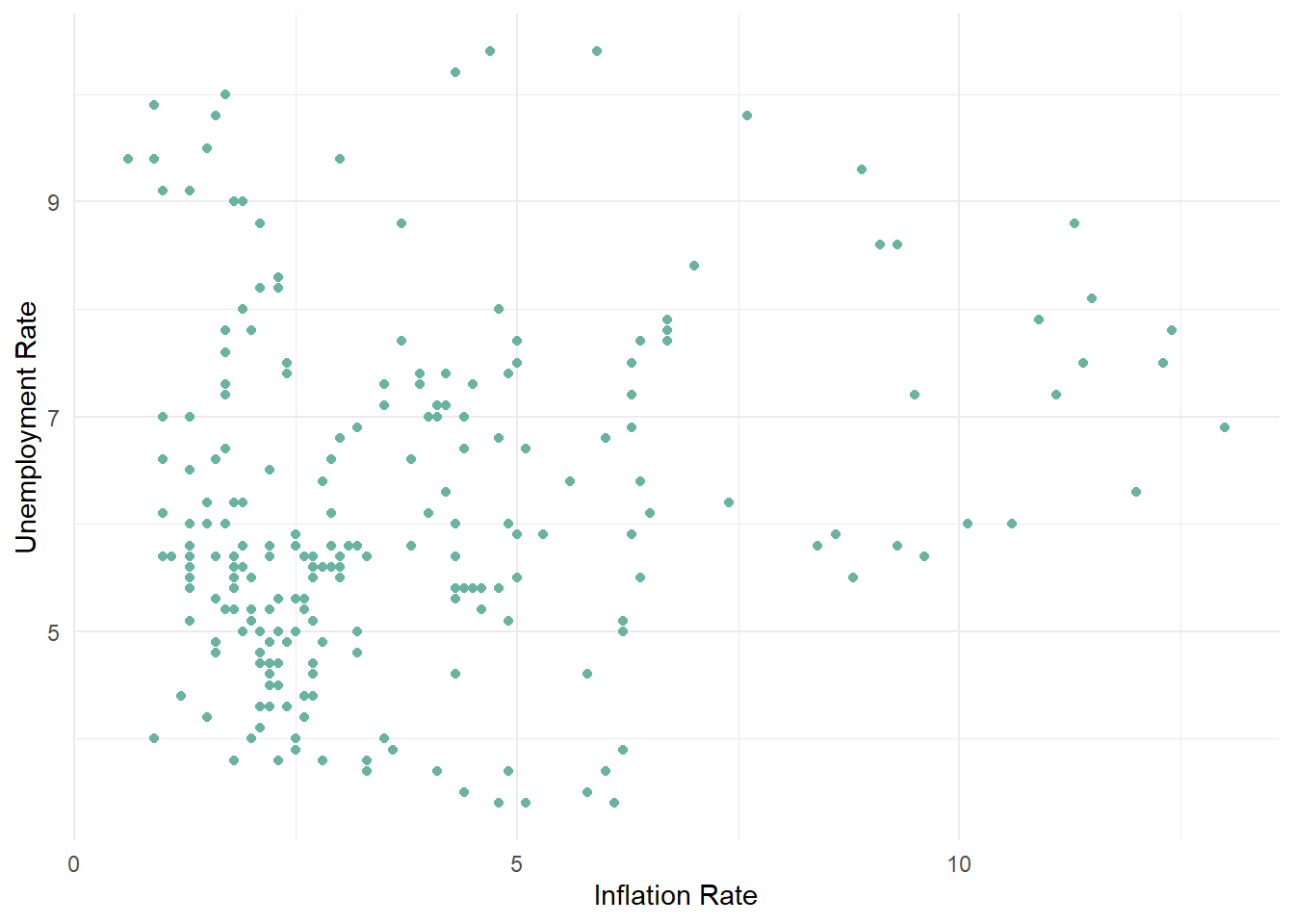

The entire data set talks about the economic stability of a country.

The data can answer questions about how the un employment and inflation rates are inter related, how the GDP change is changing year over year.

we can also see the relation between inflation rates, GDP Change as well. various combinations of column data’s can be considered and worked over.

---

title: "Homework2"

author: "Tejaswini_Ketineni"

desription: "Reading in data and creating a post"

date: "08/21/2022"

format:

html:

toc: true

code-fold: true

code-copy: true

code-tools: true

categories:

- challenge_1

- railroads

- faostat

- wildbirds

---

Homework 2

For this homework, your goal is to read in a more complicated dataset. Please use the category tag "hw2" as well as a tag for the dataset you choose to use.

Read in a dataset from the _data folder in the course blog repository, or choose your own data. If you decide to use one of the datasets we have provided, please use a challenging dataset - check with us if you are not sure.

Clean the data as needed using dplyr and related tidyverse packages.

Provide a narrative about the data set (look it up if you aren't sure what you have got) and the variables in your dataset, including what type of data each variable is. The goal of this step is to communicate in a visually appealing way to non-experts - not to replicate r-code.

Identify potential research questions that your data set can help answer.

```{r}

#| label: setup

#| warning: false

#| message: false

library(tidyverse)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)

```

The dataset that I have chosen to work is FedFunds data set which gives insights about the economics, inflation etc..,

## Read in the Data

we initially read the Fed funds data that is already present in the data folder

```{r}

library(readr)

FedFundsRate <- read_csv("_data/FedFundsRate.csv")

View(FedFundsRate)

```

## Describe the data

while we initially see the data, we see that there are a lot of NA' s in the data in the initial glance. But to understand more about the data, we need to further analyse it.

Extracting the column names

```{r}

colnames(FedFundsRate)

```

Getting the size of the data

```{r}

dim(FedFundsRate)

```

We see that there about 904 rows and 10 columns in the dataset

let's visualize the sample data

```{r}

head(FedFundsRate)

```

## Cleaning the data

let's get the summary of the data in the firstplace to clean the data.

```{r}

summary(FedFundsRate)

```

Looking at the summary we see that there are a lot of NA's present in the data in almost all the columns except for Year,Month,date.Inorder to clean the data, we must drop all the NA's present in the data.

```{r}

cleaned_fed_funds <- na.omit(FedFundsRate)

cleaned_fed_funds

```

A new data frame with the name of cleaned_fed_funds is created after dropping all the NA's.

if we drop all the NA's then we are getting no rows in the data set.Let's try an other way of dropping na's

```{r}

cleaned_fed_funds1 <- FedFundsRate %>%

drop_na(Year,`Federal Funds Target Rate`,`Federal Funds Upper Target`,`Federal Funds Lower Target`,`Effective Federal Funds Rate`,`Unemployment Rate`,`Inflation Rate`)

cleaned_fed_funds1

```

So inorder to retain the dataset, let's drop NA's from those of the columns that we would actually like to visualize or consider them important.

```{r}

cleaned_fed_funds1 <- FedFundsRate %>%

drop_na(`Effective Federal Funds Rate`,`Unemployment Rate`,`Inflation Rate`,`Real GDP (Percent Change)`)

cleaned_fed_funds1

```

```{r}

summary(cleaned_fed_funds1)

```

```{r}

cleaned_fed_funds1 <-cleaned_fed_funds1%>%

mutate_at(vars(colnames(cleaned_fed_funds1)[0:10]), function(x)as.numeric(x))

glimpse(cleaned_fed_funds1)

```

## Data Wrangling and summary statistics

```{r}

a <- cleaned_fed_funds1%>%

group_by(Year)

a

```

```{r}

table(cleaned_fed_funds1$Year)

```

we see that there are a range of years, from 1958-2016

```{r}

print(summarytools::dfSummary(cleaned_fed_funds1,

varnumbers = FALSE,

plain.ascii = FALSE,

style = "grid",

graph.magnif = 0.70,

valid.col = FALSE),

method = 'render',

table.classes = 'table-condensed')

```

Now we can look at the summary and get few insights from the data regarding the data type of the columns,statistical analysis, frequency of the data etc..,

Understanding year-wise GDP metrics

```{r}

cleaned_fed_funds1$Year<-as.factor(cleaned_fed_funds1$Year)

cleaned_fed_funds1 %>%

group_by(Year) %>%

summarise(GDP_min=min(`Real GDP (Percent Change)`),GDP_max=max(`Real GDP (Percent Change)`),GDP_mean=mean(`Real GDP (Percent Change)`), .groups = 'keep') %>%

arrange(desc(Year)) %>%

print(n = 100)

```

## Data Visualization

Lets see how un employement rate is being affected with year

```{r}

ggplot(cleaned_fed_funds1) +

aes(x = `Inflation Rate`, y = `Unemployment Rate`) +

geom_point(colour = "#69b3a2") +

theme_minimal()

```

```{r}

a <- cleaned_fed_funds1 %>%

select(Year, `Real GDP (Percent Change)`, `Inflation Rate`) %>%

gather(key = "variable", value = "value", -Year)

ggplot(a, aes(x =`Year`, y = value)) +

geom_line(aes(color = variable, linetype = variable)) +

scale_color_manual(values = c("darkred", "steelblue"))+labs(

title = "Inflation and gdp change by Year",

y = "Variable Rates", x = "Year")

```

The entire data set talks about the economic stability of a country.

The data can answer questions about how the un employment and inflation rates are inter related, how the GDP change is changing year over year.

we can also see the relation between inflation rates, GDP Change as well. various combinations of column data's can be considered and worked over.