library(tidyverse)

library(ggplot2)

library(ggforce)

library(readxl)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)Challenge 6

Challenge Overview

Today’s challenge is to:

- read in a data set, and describe the data set using both words and any supporting information (e.g., tables, etc)

- tidy data (as needed, including sanity checks)

- mutate variables as needed (including sanity checks)

- create at least one graph including time (evolution)

- try to make them “publication” ready (optional)

- Explain why you choose the specific graph type

- Create at least one graph depicting part-whole or flow relationships

- try to make them “publication” ready (optional)

- Explain why you choose the specific graph type

R Graph Gallery is a good starting point for thinking about what information is conveyed in standard graph types, and includes example R code.

(be sure to only include the category tags for the data you use!)

Read in data

Read in one (or more) of the following datasets, using the correct R package and command.

- debt ⭐

- fed_rate ⭐⭐

- abc_poll ⭐⭐⭐

- usa_hh ⭐⭐⭐

- hotel_bookings ⭐⭐⭐⭐

- AB_NYC ⭐⭐⭐⭐⭐

RawData <- read_excel("_data/debt_in_trillions.xlsx")

head(RawData)# A tibble: 6 × 8

`Year and Quarter` Mortgage `HE Revolving` Auto …¹ Credi…² Stude…³ Other Total

<chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 03:Q1 4.94 0.242 0.641 0.688 0.241 0.478 7.23

2 03:Q2 5.08 0.26 0.622 0.693 0.243 0.486 7.38

3 03:Q3 5.18 0.269 0.684 0.693 0.249 0.477 7.56

4 03:Q4 5.66 0.302 0.704 0.698 0.253 0.449 8.07

5 04:Q1 5.84 0.328 0.72 0.695 0.260 0.446 8.29

6 04:Q2 5.97 0.367 0.743 0.697 0.263 0.423 8.46

# … with abbreviated variable names ¹`Auto Loan`, ²`Credit Card`,

# ³`Student Loan`Briefly describe the data

The information appears to be the total amount of debt that some countries’ residents, most likely those of the US have.

splitData<- RawData %>%

separate(`Year and Quarter`,c('Year','Quarter'),sep = ":")

splitData# A tibble: 74 × 9

Year Quarter Mortgage `HE Revolving` `Auto Loan` Credi…¹ Stude…² Other Total

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 03 Q1 4.94 0.242 0.641 0.688 0.241 0.478 7.23

2 03 Q2 5.08 0.26 0.622 0.693 0.243 0.486 7.38

3 03 Q3 5.18 0.269 0.684 0.693 0.249 0.477 7.56

4 03 Q4 5.66 0.302 0.704 0.698 0.253 0.449 8.07

5 04 Q1 5.84 0.328 0.72 0.695 0.260 0.446 8.29

6 04 Q2 5.97 0.367 0.743 0.697 0.263 0.423 8.46

7 04 Q3 6.21 0.426 0.751 0.706 0.33 0.41 8.83

8 04 Q4 6.36 0.468 0.728 0.717 0.346 0.423 9.04

9 05 Q1 6.51 0.502 0.725 0.71 0.364 0.394 9.21

10 05 Q2 6.70 0.528 0.774 0.717 0.374 0.402 9.49

# … with 64 more rows, and abbreviated variable names ¹`Credit Card`,

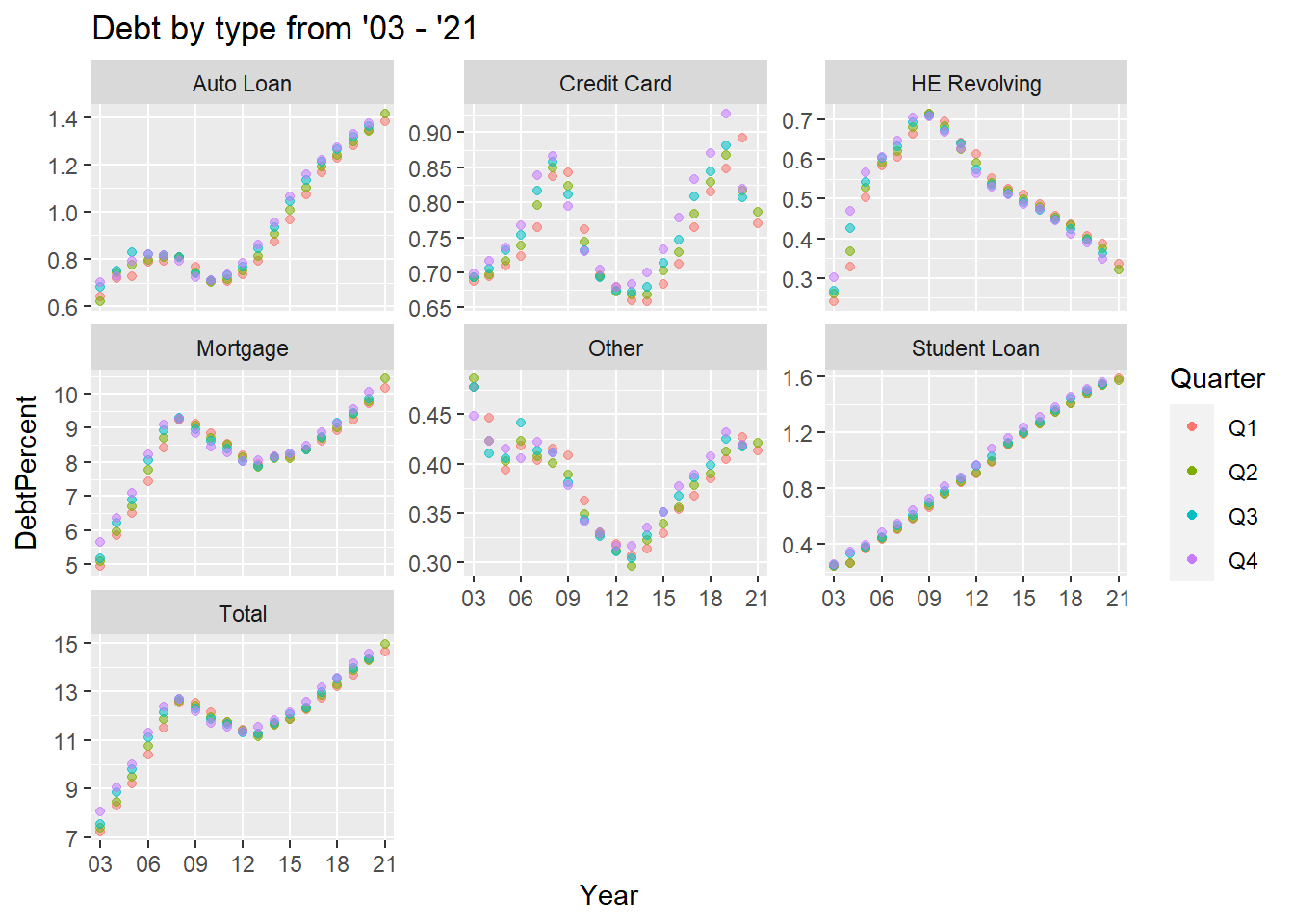

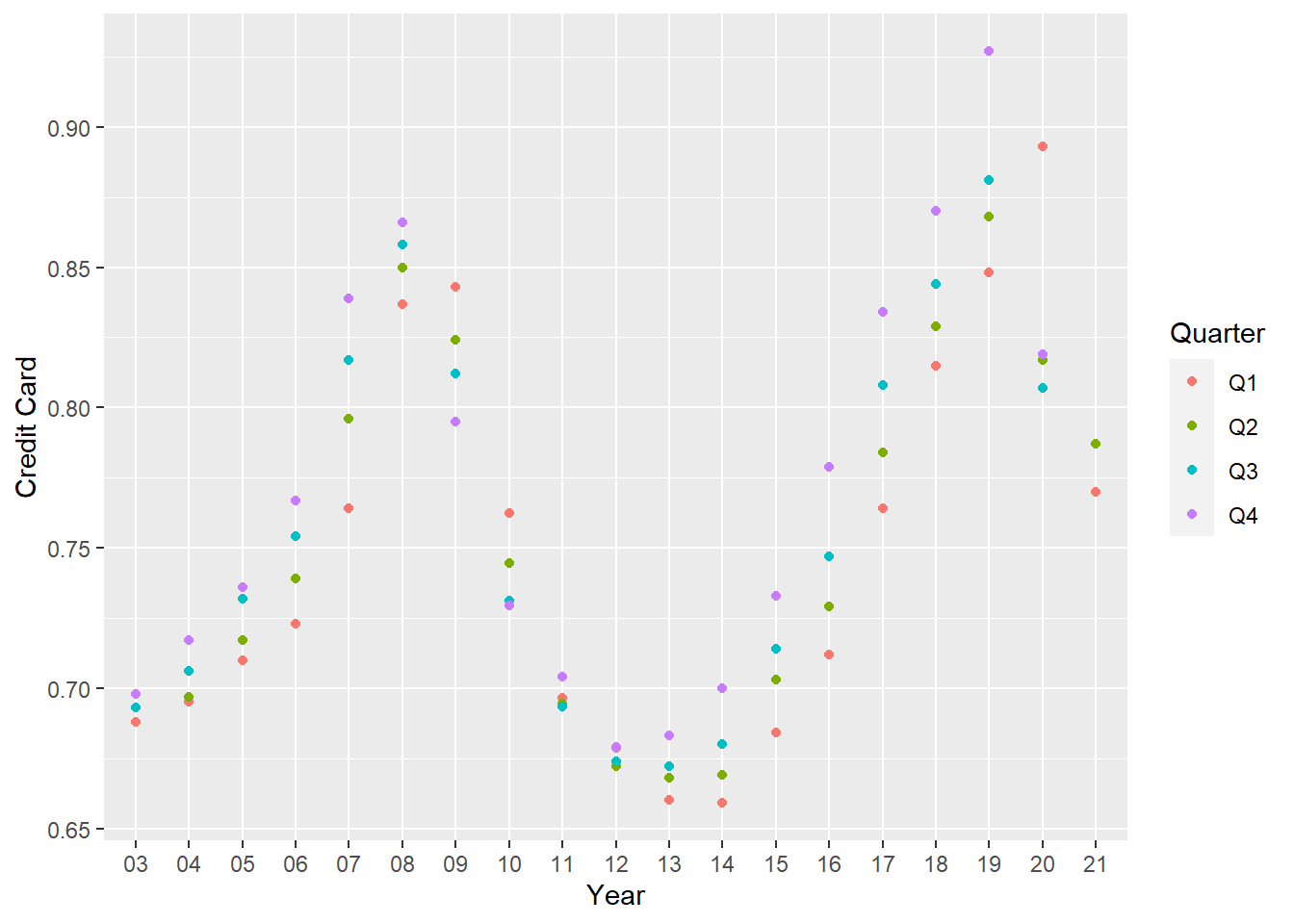

# ²`Student Loan`Time Dependent Visualization

Below is a time-dependent graphic of credit card debt; I later alter the data to compare it to other types of debt.

scatter <- splitData %>%

ggplot(mapping=aes(x = Year, y = `Credit Card`))+

geom_point(aes(color=Quarter))

scatter

pivoting data again

longerSplitData<- splitData%>%

pivot_longer(!c(Year,Quarter), names_to = "DebtType",values_to = "DebtPercent" )

longerSplitData# A tibble: 518 × 4

Year Quarter DebtType DebtPercent

<chr> <chr> <chr> <dbl>

1 03 Q1 Mortgage 4.94

2 03 Q1 HE Revolving 0.242

3 03 Q1 Auto Loan 0.641

4 03 Q1 Credit Card 0.688

5 03 Q1 Student Loan 0.241

6 03 Q1 Other 0.478

7 03 Q1 Total 7.23

8 03 Q2 Mortgage 5.08

9 03 Q2 HE Revolving 0.26

10 03 Q2 Auto Loan 0.622

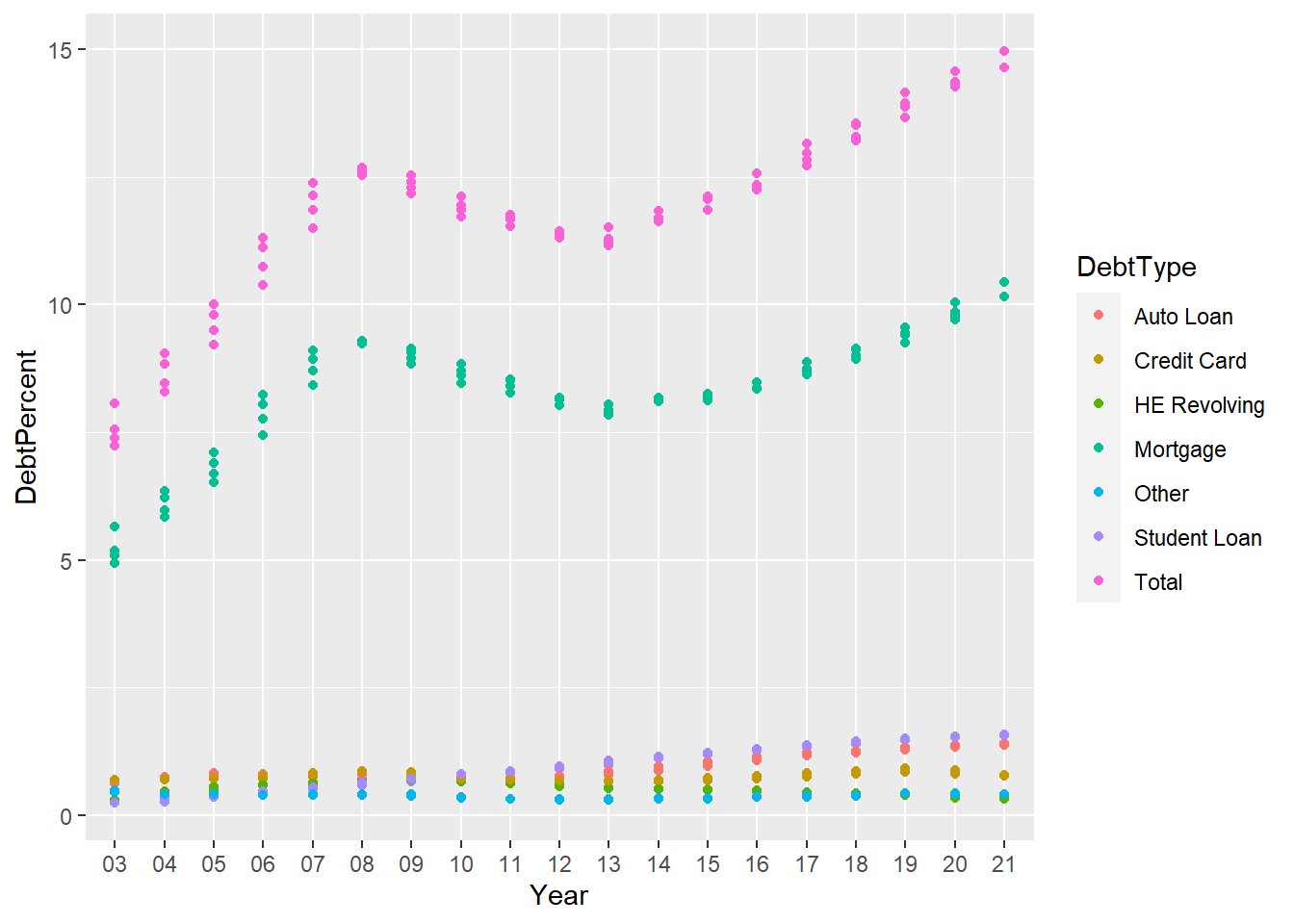

# … with 508 more rowsVisualizing Part-Whole Relationships

longerSplitDataPlot <- longerSplitData%>%

ggplot(mapping=aes(x = Year, y = DebtPercent))

longerSplitDataPlot +

facet_wrap(~DebtType, scales = "free")

#visualize the data by debt type

longerSplitDataPlot +

geom_point(aes(color = DebtType))

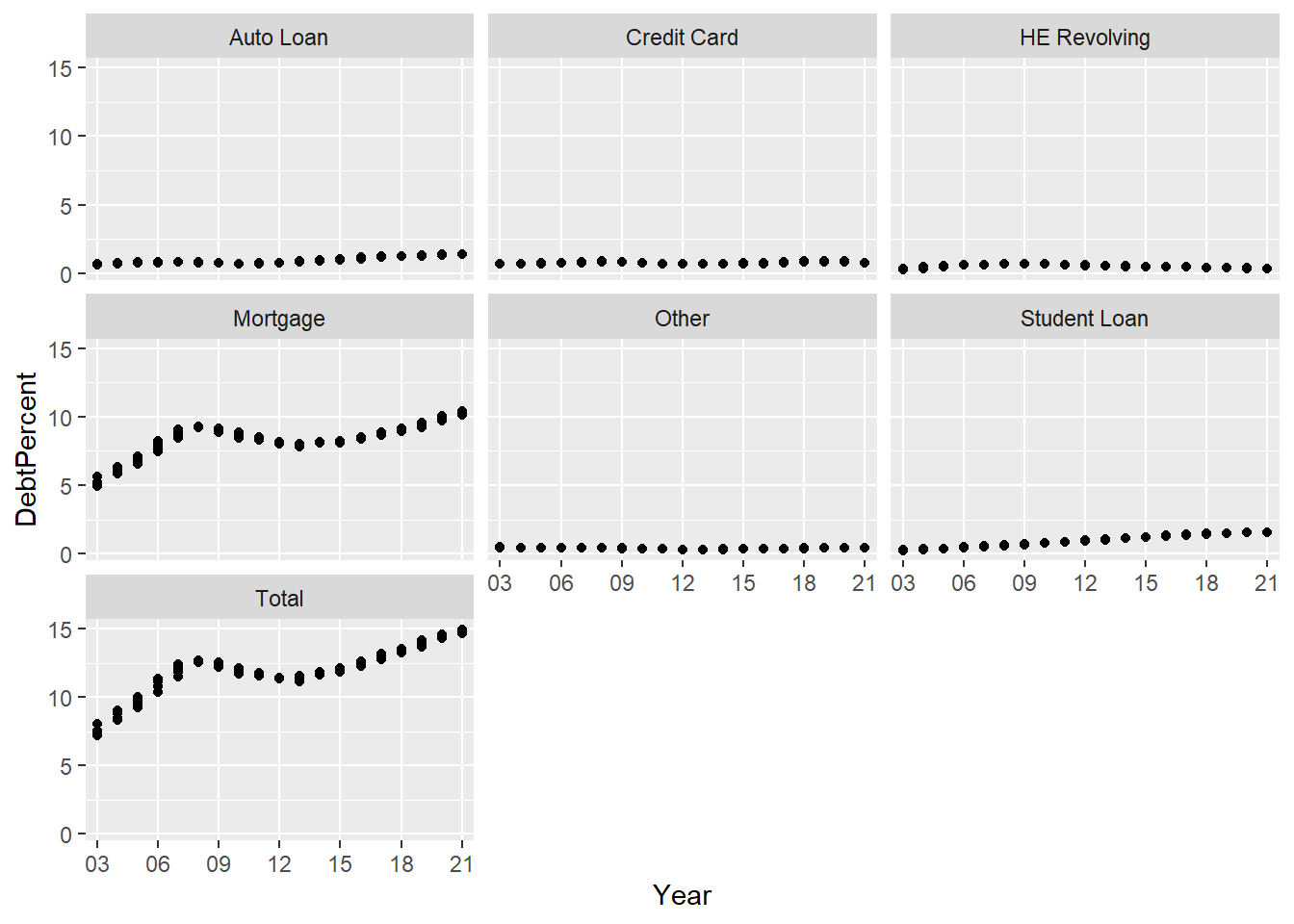

I wanted to analyze how different sorts of debt affected the total debt for that year, so I separated out the types of debt. As you can see, the mortgage debt seems to have the biggest impact on the total.

longerSplitDataPlot+

geom_point() +

facet_wrap(~DebtType) +

scale_x_discrete(breaks = c('03','06','09',12,15,18,21))

The information above shows how mortgages contributed to the total debt, but what about the trends of the other types of debt? Are they similar in shape? To view this, I had to turn the scales to the free position.

longerSplitDataPlot+

geom_point(aes(color = Quarter,alpha=0.9,)) +

facet_wrap(~DebtType, scales = "free_y") +

guides(alpha="none") +

labs(title="Debt by type from '03 - '21")+

scale_x_discrete(breaks = c('03','06','09',12,15,18,21))