Code

library(tidyverse)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)Lauren Zichittella

March 22, 2023

Read in FedFundRate.csv and utilize functions to understand dataset and formulate next steps in clean-up

[1] "Year" "Month"

[3] "Day" "Federal Funds Target Rate"

[5] "Federal Funds Upper Target" "Federal Funds Lower Target"

[7] "Effective Federal Funds Rate" "Real GDP (Percent Change)"

[9] "Unemployment Rate" "Inflation Rate" # A tibble: 6 × 10

Year Month Day Federal Fu…¹ Feder…² Feder…³ Effec…⁴ Real …⁵ Unemp…⁶ Infla…⁷

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1954 7 1 NA NA NA 0.8 4.6 5.8 NA

2 1954 8 1 NA NA NA 1.22 NA 6 NA

3 1954 9 1 NA NA NA 1.06 NA 6.1 NA

4 1954 10 1 NA NA NA 0.85 8 5.7 NA

5 1954 11 1 NA NA NA 0.83 NA 5.3 NA

6 1954 12 1 NA NA NA 1.28 NA 5 NA

# … with abbreviated variable names ¹`Federal Funds Target Rate`,

# ²`Federal Funds Upper Target`, ³`Federal Funds Lower Target`,

# ⁴`Effective Federal Funds Rate`, ⁵`Real GDP (Percent Change)`,

# ⁶`Unemployment Rate`, ⁷`Inflation Rate`# A tibble: 6 × 10

Year Month Day Federal Fu…¹ Feder…² Feder…³ Effec…⁴ Real …⁵ Unemp…⁶ Infla…⁷

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 2016 12 1 NA 0.5 0.25 0.54 NA 4.7 2.2

2 2016 12 14 NA 0.75 0.5 NA NA NA NA

3 2017 1 1 NA 0.75 0.5 0.65 NA 4.8 2.3

4 2017 2 1 NA 0.75 0.5 0.66 NA 4.7 2.2

5 2017 3 1 NA 0.75 0.5 NA NA NA NA

6 2017 3 16 NA 1 0.75 NA NA NA NA

# … with abbreviated variable names ¹`Federal Funds Target Rate`,

# ²`Federal Funds Upper Target`, ³`Federal Funds Lower Target`,

# ⁴`Effective Federal Funds Rate`, ⁵`Real GDP (Percent Change)`,

# ⁶`Unemployment Rate`, ⁷`Inflation Rate`# Create pre-tidy version of data, changing variable names to make easier to reference in code

fedfundrate_pretidy <-read_csv("_data/FedFundsRate.csv"

, skip =1

, col_names = c("year", "month", "day", "fedfunds_targetrate", "fedfunds_targetupper", "fedfunds_targetlower","fedfunds_effectiverate", "realgdp_percentchange", "unemployment_rate", "inflation_rate"))

# confirm updated read did not affect row count or column counts

nrow(fedfundrate_raw)[1] 904[1] 904[1] 10[1] 10| No | Variable | Stats / Values | Freqs (% of Valid) | Graph | Valid | Missing | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | year [numeric] |

|

64 distinct values | 904 (100.0%) | 0 (0.0%) | |||||

| 2 | month [numeric] |

|

12 distinct values | 904 (100.0%) | 0 (0.0%) | |||||

| 3 | day [numeric] |

|

29 distinct values | 904 (100.0%) | 0 (0.0%) | |||||

| 4 | fedfunds_targetrate [numeric] |

|

63 distinct values | 462 (51.1%) | 442 (48.9%) | |||||

| 5 | fedfunds_targetupper [numeric] |

|

4 distinct values | 103 (11.4%) | 801 (88.6%) | |||||

| 6 | fedfunds_targetlower [numeric] |

|

4 distinct values | 103 (11.4%) | 801 (88.6%) | |||||

| 7 | fedfunds_effectiverate [numeric] |

|

466 distinct values | 752 (83.2%) | 152 (16.8%) | |||||

| 8 | realgdp_percentchange [numeric] |

|

113 distinct values | 250 (27.7%) | 654 (72.3%) | |||||

| 9 | unemployment_rate [numeric] |

|

71 distinct values | 752 (83.2%) | 152 (16.8%) | |||||

| 10 | inflation_rate [numeric] |

|

106 distinct values | 710 (78.5%) | 194 (21.5%) |

Generated by summarytools 1.0.1 (R version 4.2.2)

2023-03-22

[1] 904# A tibble: 753 × 5

# Groups: year [64]

year month n `min(day, na.rm = T)` max_day

<dbl> <dbl> <int> <dbl> <dbl>

1 1954 7 1 1 1

2 1954 8 1 1 1

3 1954 9 1 1 1

4 1954 10 1 1 1

5 1954 11 1 1 1

6 1954 12 1 1 1

7 1955 1 1 1 1

8 1955 2 1 1 1

9 1955 3 1 1 1

10 1955 4 1 1 1

# … with 743 more rows # evaluate the missingness of measures by year;

fedfundrate_pretidy %>%

group_by(year) %>%

summarise( n = n(),

na_count_fedfunds_targetrate = sum(is.na(fedfunds_targetrate )),

na_count_fedfunds_targetupper = sum(is.na(fedfunds_targetupper)),

na_count_fedfunds_targetlower = sum(is.na(fedfunds_targetlower)),

na_count_fedfunds_effectiverate = sum(is.na(fedfunds_effectiverate )),

na_count_realgdp_percentchange = sum(is.na(realgdp_percentchange)),

na_count_unemployment_rate = sum(is.na(unemployment_rate )),

na_count_inflation_rate = sum(is.na(inflation_rate)) )# A tibble: 64 × 9

year n na_count_fedfun…¹ na_co…² na_co…³ na_co…⁴ na_co…⁵ na_co…⁶ na_co…⁷

<dbl> <int> <int> <int> <int> <int> <int> <int> <int>

1 1954 6 6 6 6 0 4 0 6

2 1955 12 12 12 12 0 8 0 12

3 1956 12 12 12 12 0 8 0 12

4 1957 12 12 12 12 0 8 0 12

5 1958 12 12 12 12 0 8 0 0

6 1959 12 12 12 12 0 8 0 0

7 1960 12 12 12 12 0 8 0 0

8 1961 12 12 12 12 0 8 0 0

9 1962 12 12 12 12 0 8 0 0

10 1963 12 12 12 12 0 8 0 0

# … with 54 more rows, and abbreviated variable names

# ¹na_count_fedfunds_targetrate, ²na_count_fedfunds_targetupper,

# ³na_count_fedfunds_targetlower, ⁴na_count_fedfunds_effectiverate,

# ⁵na_count_realgdp_percentchange, ⁶na_count_unemployment_rate,

# ⁷na_count_inflation_rate #evaluate mean and median measures by year

fedfundrate_pretidy %>%

group_by(year) %>%

summarise(avg_fedfunds_targetrate = mean(fedfunds_targetrate, na.rm=TRUE),

med_fedfunds_targetrate = median(fedfunds_targetrate, na.rm=TRUE),

avg_fedfunds_targetupper = mean(fedfunds_targetupper, na.rm=TRUE),

med_fedfunds_targetupper = median(fedfunds_targetupper, na.rm=TRUE),

avg_fedfunds_targetlower = mean(fedfunds_targetlower, na.rm=TRUE),

med_fedfunds_targetlower = median(fedfunds_targetlower, na.rm=TRUE),

avg_fedfunds_effectiverate = mean(fedfunds_effectiverate, na.rm=TRUE),

med_fedfunds_effectiverate = median(fedfunds_effectiverate, na.rm=TRUE),

avg_realgdp_percentchange= mean(realgdp_percentchange, na.rm=TRUE),

med_realgdp_percentchange = median(realgdp_percentchange, na.rm=TRUE),

avg_unemployment_rate = mean(unemployment_rate, na.rm=TRUE),

med_unemployment_rate = median(unemployment_rate, na.rm=TRUE),

avg_inflation_rate = mean(inflation_rate, na.rm=TRUE),

med_inflation_rate = median(inflation_rate, na.rm=TRUE) )# A tibble: 64 × 15

year avg_f…¹ med_f…² avg_f…³ med_f…⁴ avg_f…⁵ med_f…⁶ avg_f…⁷ med_f…⁸ avg_r…⁹

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1954 NaN NA NaN NA NaN NA 1.01 0.955 6.3

2 1955 NaN NA NaN NA NaN NA 1.78 1.66 6.62

3 1956 NaN NA NaN NA NaN NA 2.73 2.74 2.08

4 1957 NaN NA NaN NA NaN NA 3.10 3 0.425

5 1958 NaN NA NaN NA NaN NA 1.57 1.6 2.97

6 1959 NaN NA NaN NA NaN NA 3.30 3.43 4.65

7 1960 NaN NA NaN NA NaN NA 3.22 3.28 0.975

8 1961 NaN NA NaN NA NaN NA 1.96 1.99 6.35

9 1962 NaN NA NaN NA NaN NA 2.71 2.82 4.32

10 1963 NaN NA NaN NA NaN NA 3.18 3.01 5.18

# … with 54 more rows, 5 more variables: med_realgdp_percentchange <dbl>,

# avg_unemployment_rate <dbl>, med_unemployment_rate <dbl>,

# avg_inflation_rate <dbl>, med_inflation_rate <dbl>, and abbreviated

# variable names ¹avg_fedfunds_targetrate, ²med_fedfunds_targetrate,

# ³avg_fedfunds_targetupper, ⁴med_fedfunds_targetupper,

# ⁵avg_fedfunds_targetlower, ⁶med_fedfunds_targetlower,

# ⁷avg_fedfunds_effectiverate, ⁸med_fedfunds_effectiverate, …The FedFundsRate dataset is a wide data set. To make it tidy, the data will need to be pivoted long and a new variable created to represent the type of measure per observation.

# Pivot longer to convert each measure to a row in the dataset #

fedfundrate_tidy <-

fedfundrate_pretidy %>%

pivot_longer( cols = c("fedfunds_targetrate", "fedfunds_targetupper", "fedfunds_targetlower","fedfunds_effectiverate", "realgdp_percentchange", "unemployment_rate", "inflation_rate"),

names_to = "measure_varname",

values_to = "measure_value",

values_drop_na = FALSE )

# View first and last obs of pivoted data

head(fedfundrate_tidy)# A tibble: 6 × 5

year month day measure_varname measure_value

<dbl> <dbl> <dbl> <chr> <dbl>

1 1954 7 1 fedfunds_targetrate NA

2 1954 7 1 fedfunds_targetupper NA

3 1954 7 1 fedfunds_targetlower NA

4 1954 7 1 fedfunds_effectiverate 0.8

5 1954 7 1 realgdp_percentchange 4.6

6 1954 7 1 unemployment_rate 5.8# A tibble: 6 × 5

year month day measure_varname measure_value

<dbl> <dbl> <dbl> <chr> <dbl>

1 2017 3 16 fedfunds_targetupper 1

2 2017 3 16 fedfunds_targetlower 0.75

3 2017 3 16 fedfunds_effectiverate NA

4 2017 3 16 realgdp_percentchange NA

5 2017 3 16 unemployment_rate NA

6 2017 3 16 inflation_rate NA [1] 904[1] 904[1] 6328[1] 10[1] 10[1] 5[1] 6328[1] 3132# A tibble: 6 × 5

year month day measure_varname measure_value

<dbl> <dbl> <dbl> <chr> <dbl>

1 1954 7 1 fedfunds_effectiverate 0.8

2 1954 7 1 realgdp_percentchange 4.6

3 1954 7 1 unemployment_rate 5.8

4 1954 8 1 fedfunds_effectiverate 1.22

5 1954 8 1 unemployment_rate 6

6 1954 9 1 fedfunds_effectiverate 1.06

Right now, type of measure is defined using one variable. I will mutate this single value to parse types in hopes of making graphics that are more focused. A single date variable will be created by concatenating what are now separatae columns for month, day, and year into single field. This will make displaying changes over time simpler to code. Finally, I will evaluate options for graphing results to inform best options for displaying relationship between measures or lack thereof.

Next steps:

Create final graphs to show relationship between federal fund rates & other measures

a - Federal funds line graph: rate, lower target, upper target b - Federal funds line graph: rate * (GDP, Inflation rate, Unemployment rate)

There is a lot of information in this dataset and it seems the best way to display is by plotting federal fund rate only, omiting target upper and lower because they are tightly correlated with the rate and their addition makes the visuals too dense.

# A tibble: 6 × 6

year month day measure_type measure_calculation measure_value

<dbl> <dbl> <dbl> <chr> <chr> <dbl>

1 1954 7 1 fedfunds effectiverate 0.8

2 1954 7 1 realgdp percentchange 4.6

3 1954 7 1 unemployment rate 5.8

4 1954 8 1 fedfunds effectiverate 1.22

5 1954 8 1 unemployment rate 6

6 1954 9 1 fedfunds effectiverate 1.06# A tibble: 6 × 7

year month day measure_type measure_calculation measure_value measure_date

<dbl> <dbl> <dbl> <chr> <chr> <dbl> <date>

1 1954 7 1 fedfunds effectiverate 0.8 1954-07-01

2 1954 7 1 realgdp percentchange 4.6 1954-07-01

3 1954 7 1 unemployment rate 5.8 1954-07-01

4 1954 8 1 fedfunds effectiverate 1.22 1954-08-01

5 1954 8 1 unemployment rate 6 1954-08-01

6 1954 9 1 fedfunds effectiverate 1.06 1954-09-01 # A tibble: 6 × 4

measure_type measure_calculation measure_value measure_date

<chr> <chr> <dbl> <date>

1 fedfunds effectiverate 0.8 1954-07-01

2 realgdp percentchange 4.6 1954-07-01

3 unemployment rate 5.8 1954-07-01

4 fedfunds effectiverate 1.22 1954-08-01

5 unemployment rate 6 1954-08-01

6 fedfunds effectiverate 1.06 1954-09-01 # A tibble: 4 × 4

measure_type num_records min_measure_date max_measure_date

<chr> <int> <date> <date>

1 fedfunds 1420 1954-07-01 2017-03-16

2 unemployment 752 1954-07-01 2017-02-01

3 inflation 710 1958-01-01 2017-02-01

4 realgdp 250 1954-07-01 2016-10-01

# A tibble: 6 × 4

measure_type measure_calculation measure_value measure_date

<chr> <chr> <dbl> <date>

1 fedfunds effectiverate 0.8 1954-07-01

2 unemployment rate 5.8 1954-07-01

3 fedfunds effectiverate 1.22 1954-08-01

4 unemployment rate 6 1954-08-01

5 fedfunds effectiverate 1.06 1954-09-01

6 unemployment rate 6.1 1954-09-01 # A tibble: 3 × 3

# Groups: measure_type [3]

measure_type measure_calculation num_records

<chr> <chr> <int>

1 fedfunds effectiverate 752

2 inflation rate 710

3 unemployment rate 752

The FedFundRates dataset provides measures of economic conditions in the US between July 1, 1954 and March 16, 2017. Each row of data represents a distinct date (month, day, year) and can include up to 6 measurements including: federal fund target rate, federal fund upper & lower target rates, federal fund lower target rate, federal funds effective rate, GDP percent change, unemployment rate, and inflation rate. However, variable are not populated consistently across observations

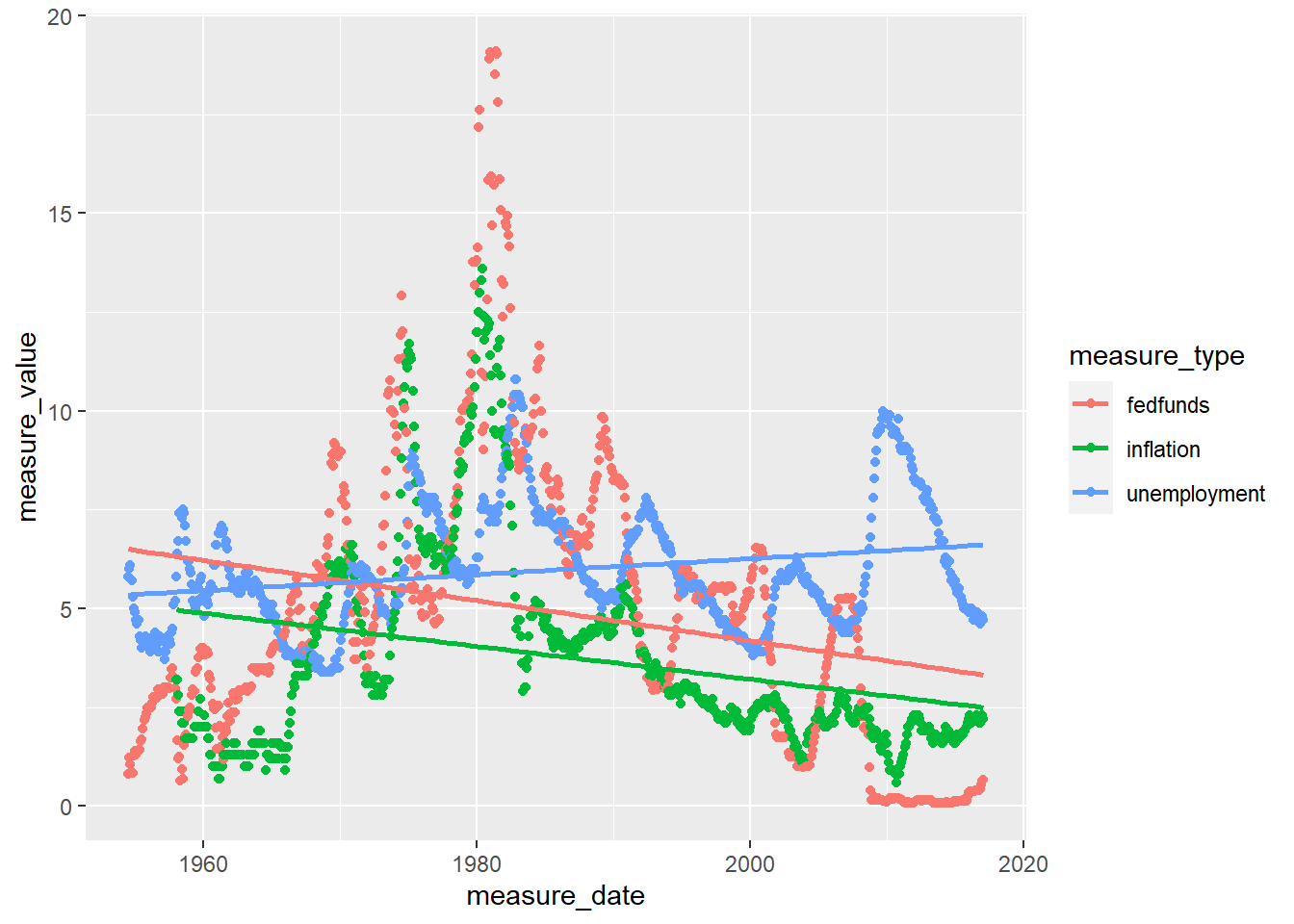

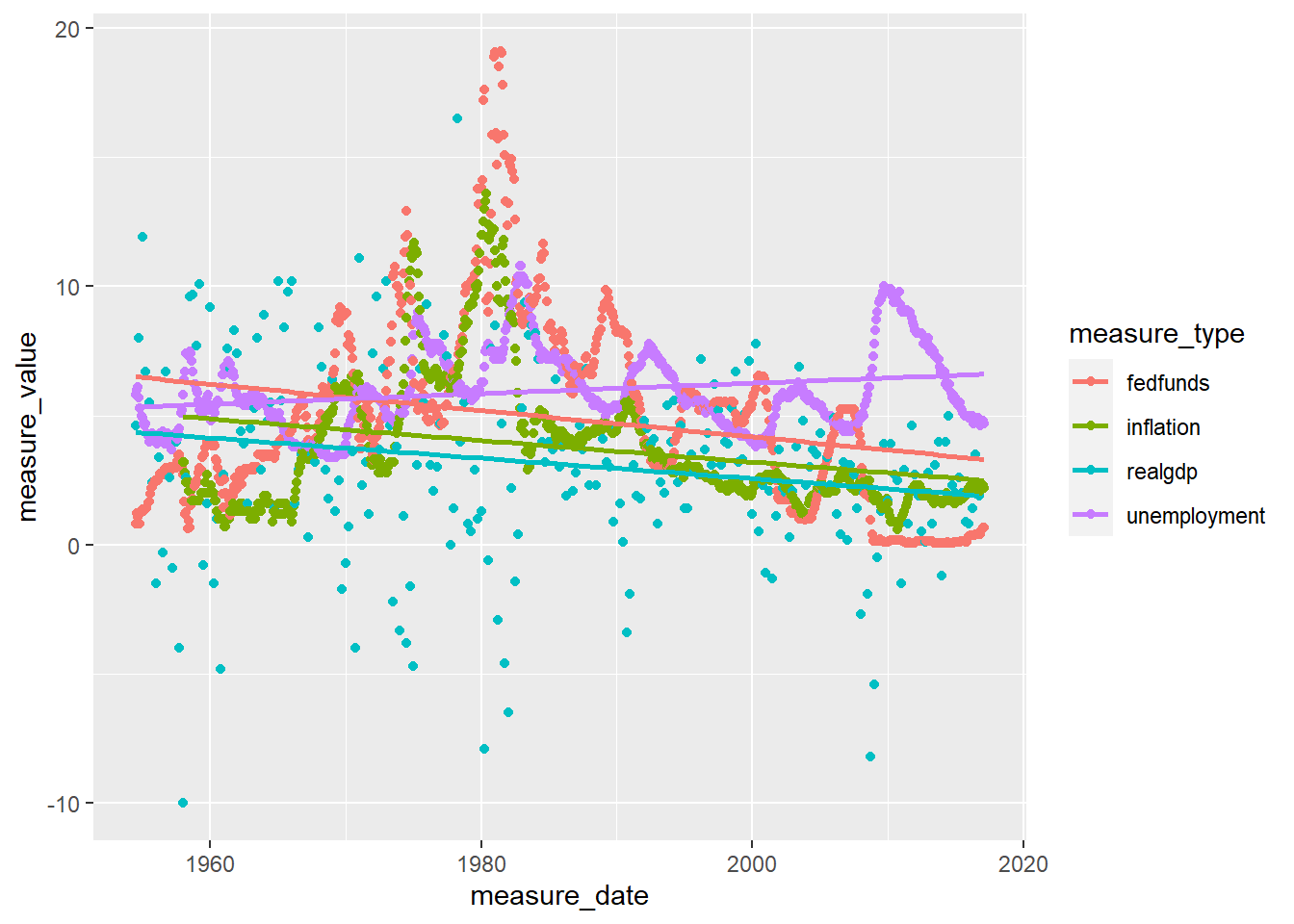

Graphs displayed below show the correlation between federal fund rates and measures for GDP, unemployment, and inflation. In short, how rates decrease alongside negative trends in economic health.

# filter dataframe to retain federal fund effective, GDP, unemployment, and inflation rates

fedfunds_final_graph <-

fedfundrate_tidy%>%

filter(measure_type=="fedfunds" & measure_calculation == "effectiverate"| measure_type !="fedfunds")

# confirm correct records selected

fedfunds_final_graph%>%

group_by (measure_type, measure_calculation )%>%

summarise(num_records = n()) # A tibble: 4 × 3

# Groups: measure_type [4]

measure_type measure_calculation num_records

<chr> <chr> <int>

1 fedfunds effectiverate 752

2 inflation rate 710

3 realgdp percentchange 250

4 unemployment rate 752# A tibble: 6 × 4

measure_type measure_calculation measure_value measure_date

<chr> <chr> <dbl> <date>

1 fedfunds effectiverate 0.8 1954-07-01

2 realgdp percentchange 4.6 1954-07-01

3 unemployment rate 5.8 1954-07-01

4 fedfunds effectiverate 1.22 1954-08-01

5 unemployment rate 6 1954-08-01

6 fedfunds effectiverate 1.06 1954-09-01

---

title: "Challenge 4: FedFundRate.csv Clean Up"

author: "Lauren Zichittella"

description: "More data wrangling: pivoting"

date: "03/22/2023"

format:

html:

toc: true

code-fold: true

code-copy: true

code-tools: true

categories:

- challenge_4

- fed_rates

- laurenzichittella

---

```{r}

#| label: setup

#| warning: false

#| message: false

library(tidyverse)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)

```

## Read in data

Read in FedFundRate.csv and utilize functions to understand dataset and formulate next steps in clean-up

### Steps

1) Import data set. Utilize functions to understand data structure

2) Recreate data with better named columns to faciliate easier processing downstream

3) Utilize "sanity checks" to confirm no errors in logic or understanding

4) Output basic characterization of dataset

### Next stepts

1) Create tidy version of dataset where each row represents a distinct date and type measurement

2) Further characterize data to inform any additional cleaning to be done and start planning for graphical display

```{r}

# Read in dataset and evaluate basics to understand any necessary basic cleanings that should be done before tidying

fedfundrate_raw <-read_csv("_data/FedFundsRate.csv")

colnames(fedfundrate_raw)

head(fedfundrate_raw)

tail(fedfundrate_raw)

# Create pre-tidy version of data, changing variable names to make easier to reference in code

fedfundrate_pretidy <-read_csv("_data/FedFundsRate.csv"

, skip =1

, col_names = c("year", "month", "day", "fedfunds_targetrate", "fedfunds_targetupper", "fedfunds_targetlower","fedfunds_effectiverate", "realgdp_percentchange", "unemployment_rate", "inflation_rate"))

# confirm updated read did not affect row count or column counts

nrow(fedfundrate_raw)

nrow(fedfundrate_pretidy)

ncol(fedfundrate_raw)

ncol(fedfundrate_pretidy)

# Output basic summary to describe dataset

# quick summary

print(summarytools::dfSummary(fedfundrate_pretidy,

plain.ascii = FALSE,

style = "grid",

graph.magnif = 0.70, ),

method = 'render',

table.classes = 'table-condensed')

# Confirm date distinct by row

fedfundrate_pretidy%>%

select(year,month,day)%>%

n_distinct()

# evaluate the count of records per year/month & distribution of day

fedfundrate_pretidy %>%

group_by(year,month) %>%

summarise( n = n()

, min(day, na.rm=T)

, max_day = max(day, na.rm=T))%>%

arrange(year, month)

# evaluate the missingness of measures by year;

fedfundrate_pretidy %>%

group_by(year) %>%

summarise( n = n(),

na_count_fedfunds_targetrate = sum(is.na(fedfunds_targetrate )),

na_count_fedfunds_targetupper = sum(is.na(fedfunds_targetupper)),

na_count_fedfunds_targetlower = sum(is.na(fedfunds_targetlower)),

na_count_fedfunds_effectiverate = sum(is.na(fedfunds_effectiverate )),

na_count_realgdp_percentchange = sum(is.na(realgdp_percentchange)),

na_count_unemployment_rate = sum(is.na(unemployment_rate )),

na_count_inflation_rate = sum(is.na(inflation_rate)) )

#evaluate mean and median measures by year

fedfundrate_pretidy %>%

group_by(year) %>%

summarise(avg_fedfunds_targetrate = mean(fedfunds_targetrate, na.rm=TRUE),

med_fedfunds_targetrate = median(fedfunds_targetrate, na.rm=TRUE),

avg_fedfunds_targetupper = mean(fedfunds_targetupper, na.rm=TRUE),

med_fedfunds_targetupper = median(fedfunds_targetupper, na.rm=TRUE),

avg_fedfunds_targetlower = mean(fedfunds_targetlower, na.rm=TRUE),

med_fedfunds_targetlower = median(fedfunds_targetlower, na.rm=TRUE),

avg_fedfunds_effectiverate = mean(fedfunds_effectiverate, na.rm=TRUE),

med_fedfunds_effectiverate = median(fedfunds_effectiverate, na.rm=TRUE),

avg_realgdp_percentchange= mean(realgdp_percentchange, na.rm=TRUE),

med_realgdp_percentchange = median(realgdp_percentchange, na.rm=TRUE),

avg_unemployment_rate = mean(unemployment_rate, na.rm=TRUE),

med_unemployment_rate = median(unemployment_rate, na.rm=TRUE),

avg_inflation_rate = mean(inflation_rate, na.rm=TRUE),

med_inflation_rate = median(inflation_rate, na.rm=TRUE) )

```

## Tidy Data

The FedFundsRate dataset is a wide data set. To make it tidy, the data will need to be pivoted long and a new variable created to represent the type of measure per observation.

## Steps

1) Pivot data longer to create one observation per distinct date (month, day, year) and type of measurement. Evaluate pivot results in the to confirm results as expected, proper number of rows and columns

2) Drop records with missing value for measure

3) Evaluate distribution of day by measure, year and month. Drop if single measure per each category to simplify going forward

4) Evaluate frequency of records by measure type, year, and month to identify measures populated for sample time period to graph for analysis

## Next steps

1) Create single date variable by concatenating month, day, and year into single variable

2) Mutate measure_varname to facilitate easier filtering to create graphics

3) Test out ggplot options for displaying data

```{r}

# Pivot longer to convert each measure to a row in the dataset #

fedfundrate_tidy <-

fedfundrate_pretidy %>%

pivot_longer( cols = c("fedfunds_targetrate", "fedfunds_targetupper", "fedfunds_targetlower","fedfunds_effectiverate", "realgdp_percentchange", "unemployment_rate", "inflation_rate"),

names_to = "measure_varname",

values_to = "measure_value",

values_drop_na = FALSE )

# View first and last obs of pivoted data

head(fedfundrate_tidy)

tail(fedfundrate_tidy)

# Evaluate pivot results to confirm valid

# row counts

nrow(fedfundrate_raw)

nrow(fedfundrate_pretidy)

nrow(fedfundrate_tidy)

# column counts

ncol(fedfundrate_raw)

ncol(fedfundrate_pretidy)

ncol(fedfundrate_tidy)

# calculation check

nrow(fedfundrate_pretidy) * 7

# Remove observations where measure value missing;

fedfundrate_tidy <-

fedfundrate_tidy %>%

filter(!is.na(measure_value))

# Capture change in row number, evaluate observations to confirm look as expected;

nrow(fedfundrate_tidy)

head(fedfundrate_tidy)

# Create table with frequency of day value by measure, month, and year

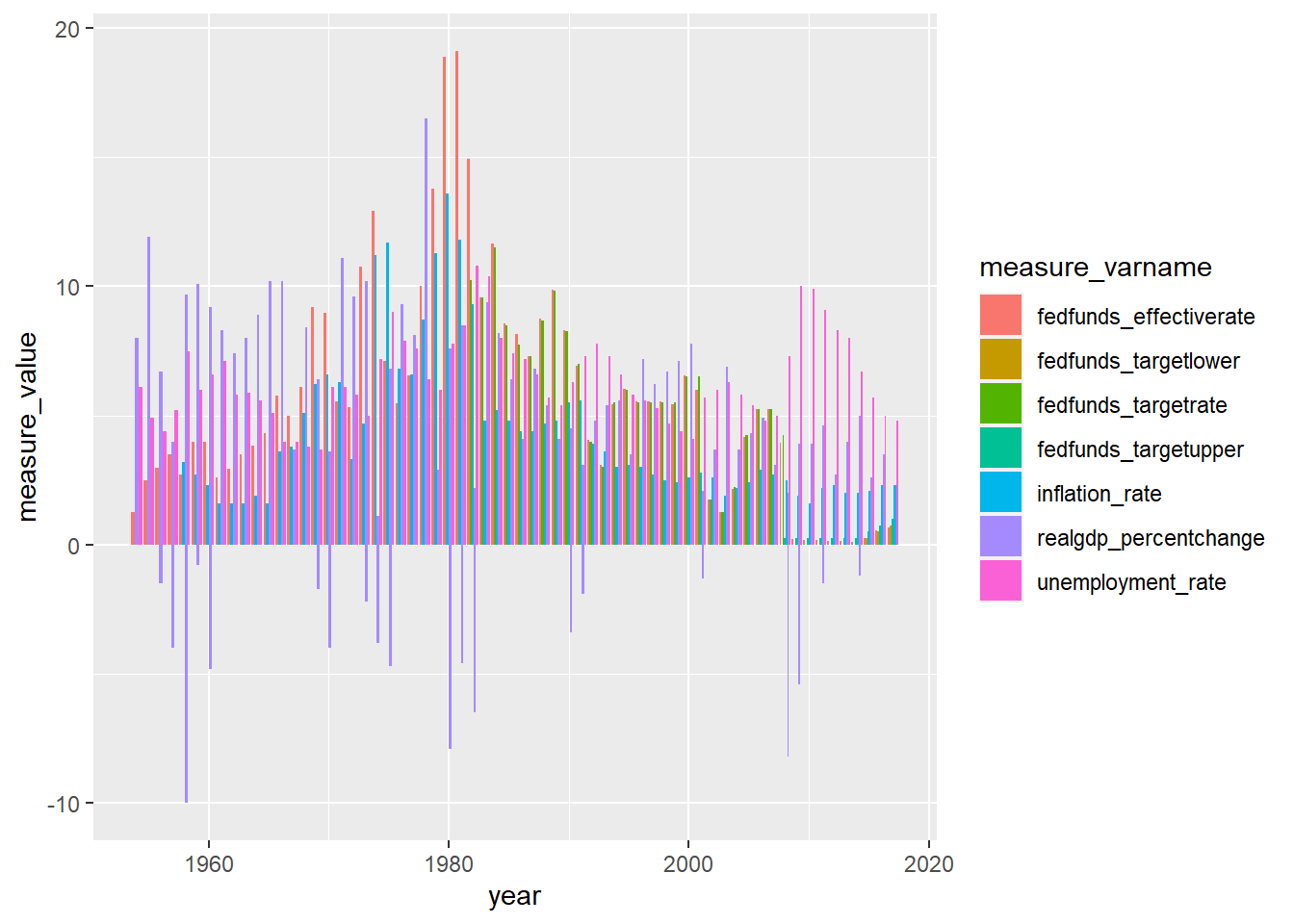

ggplot(fedfundrate_tidy,aes(x = year, y =measure_value, fill = measure_varname)) +

geom_bar(stat = "identity", position = "dodge")

```

## Mutate variables

Right now, type of measure is defined using one variable. I will mutate this single value to parse types in hopes of making graphics that are more focused. A single date variable will be created by concatenating what are now separatae columns for month, day, and year into single field. This will make displaying changes over time simpler to code. Finally, I will evaluate options for graphing results to inform best options for displaying relationship between measures or lack thereof.

### Steps

1) Mutate measure_varname to create separate variable for measure type and measure calculation

2) Create single date variable from month, day, and year

3) Create histogram to evaluate values of percent change GDP and figure out how to display this measure alongside others

4) Utilize new variables to filter, plot data, figure out best choice to graph relationships across measures and types

Next steps:

Create final graphs to show relationship between federal fund rates & other measures

a - Federal funds line graph: rate, lower target, upper target

b - Federal funds line graph: rate * (GDP, Inflation rate, Unemployment rate)

### Conclusion

There is a lot of information in this dataset and it seems the best way to display is by plotting federal fund rate only, omiting target upper and lower because they are tightly correlated with the rate and their addition makes the visuals too dense.

```{r}

# Create two new variables to represent measure type and calculation

fedfundrate_tidy <-

fedfundrate_tidy %>%

separate(measure_varname, c("measure_type", "measure_calculation"), sep = "_")

# confirm variables created as intended.

head(fedfundrate_tidy)

# Create single date field by combining variables month, day, and year

fedfundrate_tidy <-

fedfundrate_tidy %>%

mutate('measure_date' = make_date(year = year, month = month, day = day))

# confirm variables created as intended.

head(fedfundrate_tidy)

# Remove columns for month, day, and year

fedfundrate_tidy <-

fedfundrate_tidy %>%

select(-year, -month, -day)

# confirm variables removed as intended.

head(fedfundrate_tidy)

# evaluate distribution of records and year across values of measure_type

fedfundrate_tidy%>%

group_by(measure_type)%>%

summarise(num_records = n(),

min_measure_date = min(measure_date),

max_measure_date = max(measure_date))%>%

arrange(desc(num_records))

# Look at histogram by measure calculation to evaluate distributions of rates versus percent change

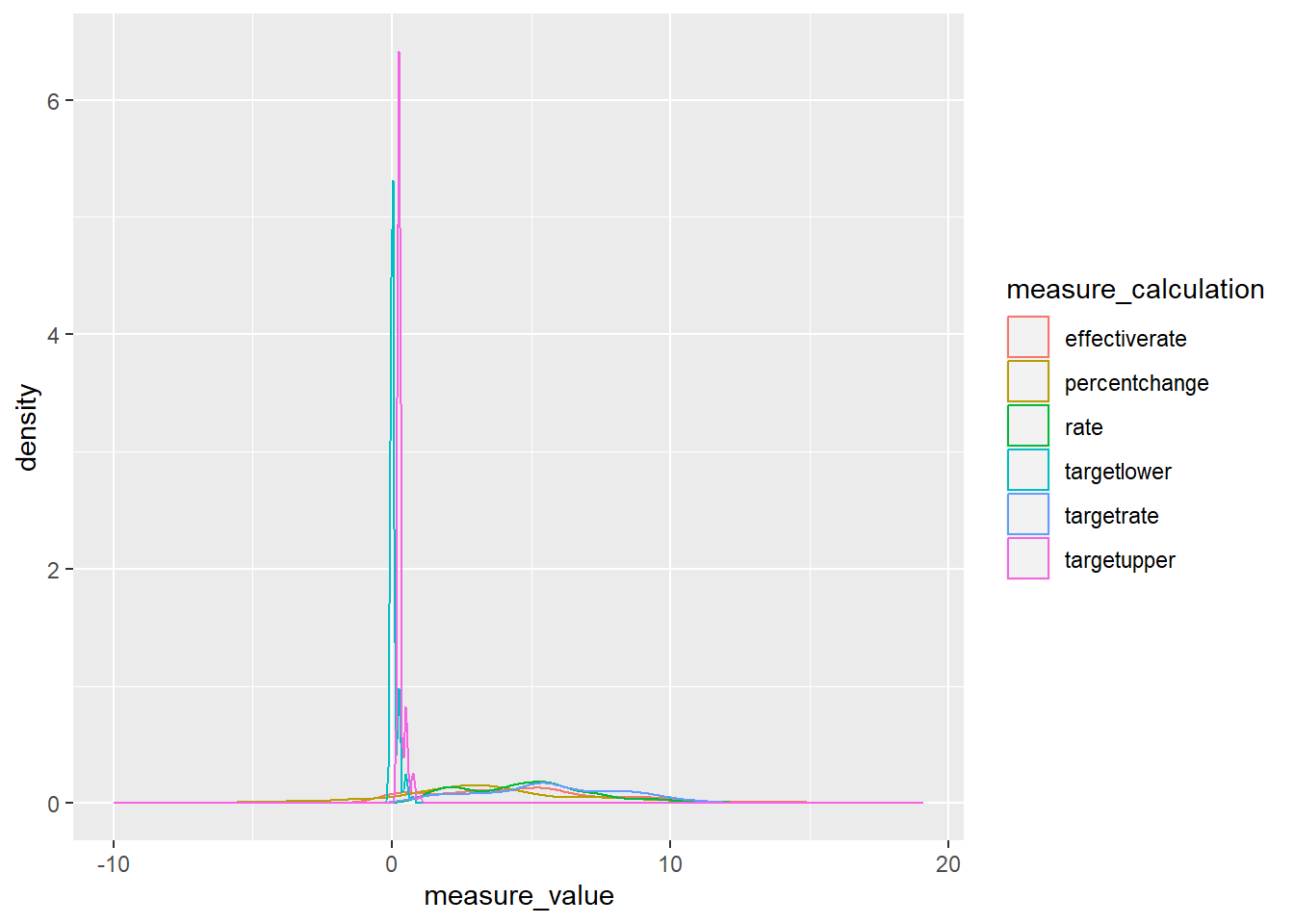

ggplot(fedfundrate_tidy,

aes(x = measure_value, color = measure_calculation)) +

geom_density()

# isolate federal fund fed funds effective rate plus non-fedfunds measure

fedfunds_graph <-

fedfundrate_tidy%>%

filter(measure_type=="fedfunds" & measure_calculation == "effectiverate"| measure_type !="fedfunds"& measure_type !="realgdp")

head(fedfunds_graph)

# confirm correct records selected

fedfunds_graph%>%

group_by (measure_type, measure_calculation )%>%

summarise(num_records = n())

# Create graph to show relationship between fed fund rate and other rate measures excluding % change GDP

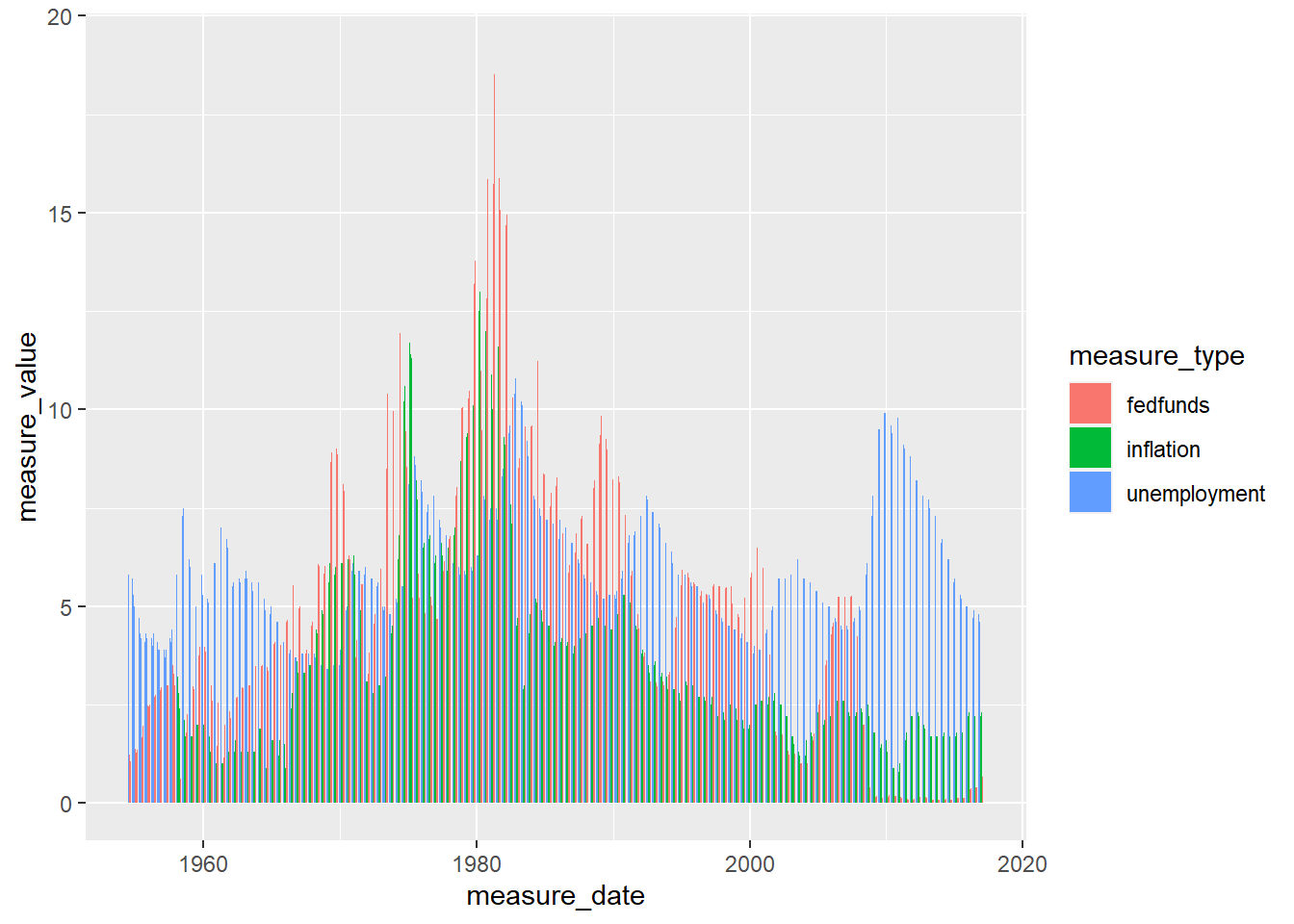

# bar chart - not great a great result. Next!

ggplot(fedfunds_graph,aes(x = measure_date, y =measure_value, fill = measure_type)) +

geom_bar(stat = "identity", position = "dodge")

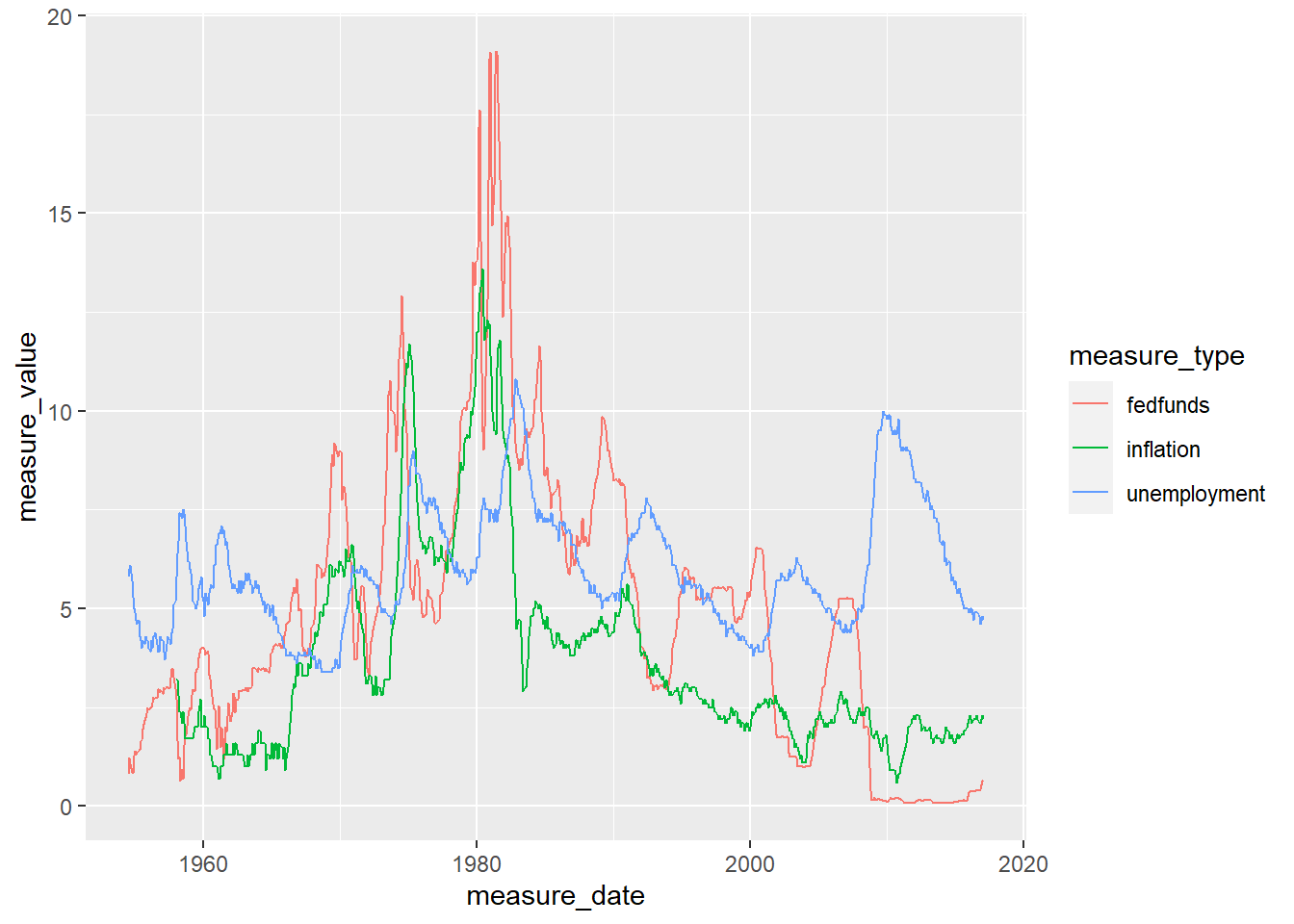

# line plot - this is better but hard to see trend. Next!

ggplot(fedfunds_graph, aes(x=measure_date, y=measure_value, group=measure_type, color=measure_type)) +

geom_line()

# line plot with regression line. That's much better!

ggplot(fedfunds_graph, aes(x = measure_date, y = measure_value, color = measure_type)) +

geom_point() +

geom_smooth(method = "lm", fill = NA)

```

## Data Description

The FedFundRates dataset provides measures of economic conditions in the US between July 1, 1954 and March 16, 2017. Each row of data represents a distinct date (month, day, year) and can include up to 6 measurements including: federal fund target rate, federal fund upper & lower target rates, federal fund lower target rate, federal funds effective rate, GDP percent change, unemployment rate, and inflation rate. However, variable are not populated consistently across observations

Graphs displayed below show the correlation between federal fund rates and measures for GDP, unemployment, and inflation. In short, how rates decrease alongside negative trends in economic health.

```{r}

# filter dataframe to retain federal fund effective, GDP, unemployment, and inflation rates

fedfunds_final_graph <-

fedfundrate_tidy%>%

filter(measure_type=="fedfunds" & measure_calculation == "effectiverate"| measure_type !="fedfunds")

# confirm correct records selected

fedfunds_final_graph%>%

group_by (measure_type, measure_calculation )%>%

summarise(num_records = n())

head(fedfunds_final_graph)

# line plot with regression line. That's much better!

ggplot(fedfunds_final_graph, aes(x = measure_date, y = measure_value, color = measure_type)) +

geom_point() +

geom_smooth(method = "lm", fill = NA)

```