Code

library(tidyverse)

library(readxl)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)Jerin Jacob

August 18, 2022

The debt dataset is the category wise debt data in trillions from the first quarter of the year 2003 to the second quarter of 2021.

# A tibble: 74 × 8

Year_Quarter Mortgage HE_Revolving Auto_Loan Credit_Card Studen…¹ Other Total

<chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 03:Q1 4.94 0.242 0.641 0.688 0.241 0.478 7.23

2 03:Q2 5.08 0.26 0.622 0.693 0.243 0.486 7.38

3 03:Q3 5.18 0.269 0.684 0.693 0.249 0.477 7.56

4 03:Q4 5.66 0.302 0.704 0.698 0.253 0.449 8.07

5 04:Q1 5.84 0.328 0.72 0.695 0.260 0.446 8.29

6 04:Q2 5.97 0.367 0.743 0.697 0.263 0.423 8.46

7 04:Q3 6.21 0.426 0.751 0.706 0.33 0.41 8.83

8 04:Q4 6.36 0.468 0.728 0.717 0.346 0.423 9.04

9 05:Q1 6.51 0.502 0.725 0.71 0.364 0.394 9.21

10 05:Q2 6.70 0.528 0.774 0.717 0.374 0.402 9.49

# … with 64 more rows, and abbreviated variable name ¹Student_Loan

# ℹ Use `print(n = ...)` to see more rowsIt has 6 types of debt variables namely Mortgage, Home Equity revolving debt, Auto Loan, Credit Card, Student Loan and a column for all other debts. The total debt got almost doubled over the period from 2003 to 2021.

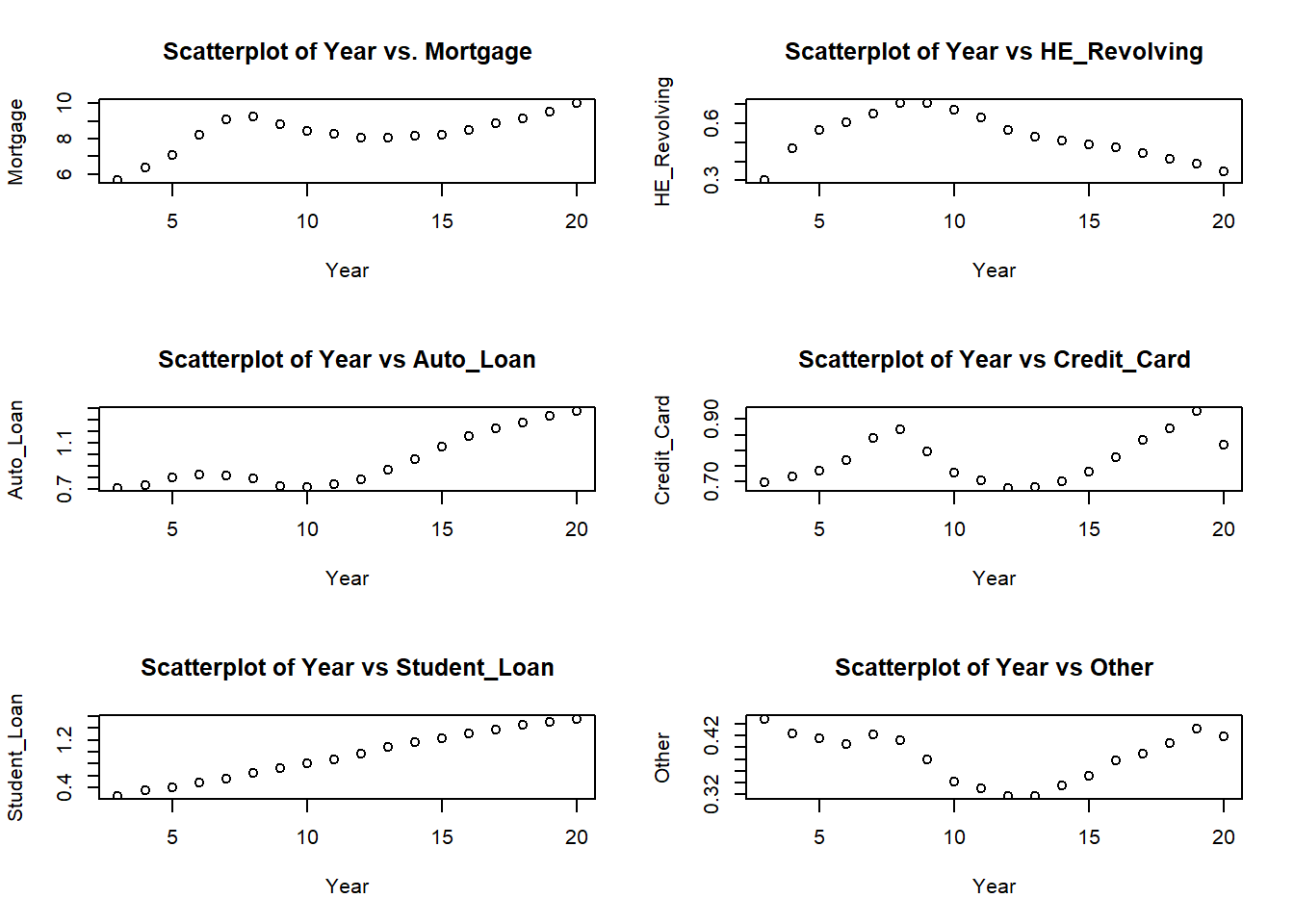

The data has been filtered so that we can take the debt details at the year-ending quarter.

attach(debt)

par(mfrow=c(3,2))

plot(Year, Mortgage, main="Scatterplot of Year vs. Mortgage")

plot(Year, HE_Revolving, main="Scatterplot of Year vs HE_Revolving")

plot(Year, Auto_Loan, main="Scatterplot of Year vs Auto_Loan")

plot(Year, Credit_Card, main="Scatterplot of Year vs Credit_Card")

plot(Year, Student_Loan, main="Scatterplot of Year vs Student_Loan")

plot(Year, Other, main="Scatterplot of Year vs Other")

When the data is being visualized, we get a more clear idea about the trend for each type of debts over the years. Student loan showed a steady increase in the whole period. Mortgage, Auto Loan and Credit card showed an up trend from the year 2003 to 2008 and then had a decline for a couple of years and again started to regain the uptrend. HE Revolving, eventhough doubled in the period till 2008, continuously declined after that.

Each variables’ contribution to the total debt is taken as percentage values.

debt_in_percentage <- debt %>%

mutate(Mortgage = (Mortgage/Total)*100,

HE_Rev = (HE_Revolving/Total)*100,

AutoLoan = (Auto_Loan/Total)*100,

CreditCard = (Credit_Card/Total)*100,

StudentLoan = (Student_Loan/Total)*100,

Others = (Other/Total)*100)

debt_in_percentage <- debt_in_percentage %>%

select(Year, Mortgage, HE_Rev, AutoLoan, CreditCard, StudentLoan, Others)

debt_in_percentage# A tibble: 18 × 7

Year Mortgage HE_Rev AutoLoan CreditCard StudentLoan Others

<chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 03 70.2 3.74 8.73 8.65 3.14 5.56

2 04 70.3 5.18 8.05 7.93 3.82 4.68

3 05 71.0 5.65 7.92 7.36 3.92 4.15

4 06 72.8 5.34 7.26 6.78 4.26 3.59

5 07 73.6 5.23 6.59 6.78 4.43 3.41

6 08 73.1 5.56 6.24 6.84 5.05 3.25

7 09 72.7 5.81 5.93 6.53 5.93 3.11

8 10 72.2 5.70 6.07 6.23 6.93 2.91

9 11 71.7 5.44 6.36 6.10 7.57 2.86

10 12 70.8 4.96 6.90 5.99 8.52 2.80

11 13 69.9 4.59 7.49 5.93 9.37 2.75

12 14 69.1 4.31 8.07 5.92 9.78 2.83

13 15 68.1 4.02 8.78 6.05 10.2 2.90

14 16 67.4 3.76 9.20 6.19 10.4 3.00

15 17 67.6 3.38 9.29 6.34 10.5 2.96

16 18 67.4 3.04 9.41 6.42 10.8 3.01

17 19 67.6 2.76 9.41 6.55 10.7 3.05

18 20 69.0 2.40 9.44 5.63 10.7 2.88In any given year, Mortgage contributes the highest to the total debt. The contribution of Student Loan is increasing over the years and in 2020 it has reached above 10 % of the total debt.

---

title: "Challenge 4"

author: "Jerin Jacob"

desription: "More data wrangling: pivoting"

date: "08/18/2022"

format:

html:

toc: true

code-fold: true

code-copy: true

code-tools: true

categories:

- challenge_4

---

```{r}

#| label: setup

#| warning: false

#| message: false

library(tidyverse)

library(readxl)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)

```

## Read in data

The debt dataset is the category wise debt data in trillions from the first quarter of the year 2003 to the second quarter of 2021.

```{r}

debt <-read_excel("_data/debt_in_trillions.xlsx", skip= 1, col_names = c("Year_Quarter", "Mortgage", "HE_Revolving", "Auto_Loan", "Credit_Card", "Student_Loan", "Other", "Total"))

debt

```

It has 6 types of debt variables namely Mortgage, Home Equity revolving debt, Auto Loan, Credit Card, Student Loan and a column for all other debts. The total debt got almost doubled over the period from 2003 to 2021.

## Tidy Data (as needed)

```{r}

debt<-debt%>%

separate("Year_Quarter", into=c("Year", "Quarter"), sep=":")%>%

fill(Quarter)

#debt

```

```{r}

debt <- debt %>%

filter(Quarter == "Q4") %>%

select(!contains("Quarter"))

#debt

```

The data has been filtered so that we can take the debt details at the year-ending quarter.

```{r}

attach(debt)

par(mfrow=c(3,2))

plot(Year, Mortgage, main="Scatterplot of Year vs. Mortgage")

plot(Year, HE_Revolving, main="Scatterplot of Year vs HE_Revolving")

plot(Year, Auto_Loan, main="Scatterplot of Year vs Auto_Loan")

plot(Year, Credit_Card, main="Scatterplot of Year vs Credit_Card")

plot(Year, Student_Loan, main="Scatterplot of Year vs Student_Loan")

plot(Year, Other, main="Scatterplot of Year vs Other")

```

When the data is being visualized, we get a more clear idea about the trend for each type of debts over the years. Student loan showed a steady increase in the whole period. Mortgage, Auto Loan and Credit card showed an up trend from the year 2003 to 2008 and then had a decline for a couple of years and again started to regain the uptrend. HE Revolving, eventhough doubled in the period till 2008, continuously declined after that.

## Contribution to the total debt

Each variables' contribution to the total debt is taken as percentage values.

```{r}

debt_in_percentage <- debt %>%

mutate(Mortgage = (Mortgage/Total)*100,

HE_Rev = (HE_Revolving/Total)*100,

AutoLoan = (Auto_Loan/Total)*100,

CreditCard = (Credit_Card/Total)*100,

StudentLoan = (Student_Loan/Total)*100,

Others = (Other/Total)*100)

debt_in_percentage <- debt_in_percentage %>%

select(Year, Mortgage, HE_Rev, AutoLoan, CreditCard, StudentLoan, Others)

debt_in_percentage

```

In any given year, Mortgage contributes the highest to the total debt. The contribution of Student Loan is increasing over the years and in 2020 it has reached above 10 % of the total debt.