library(tidyverse)

library(summarytools)

library(lubridate)

library(ggplot2)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)Challenge 6

Challenge Overview

Today’s challenge is to:

- read in a data set, and describe the data set using both words and any supporting information (e.g., tables, etc)

- tidy data (as needed, including sanity checks)

- mutate variables as needed (including sanity checks)

- create at least one graph including time (evolution)

- try to make them “publication” ready (optional)

- Explain why you choose the specific graph type

- Create at least one graph depicting part-whole or flow relationships

- try to make them “publication” ready (optional)

- Explain why you choose the specific graph type

R Graph Gallery is a good starting point for thinking about what information is conveyed in standard graph types, and includes example R code.

(be sure to only include the category tags for the data you use!)

Read in data

fed_orig<-read_csv("_data/FedFundsRate.csv",

skip=1,

col_names=c("year","month","day","fedfunds_target","fedfunds_upper","fedfunds_lower","fedfunds_eff","realgdp_change","unemploy_rate","inflation_rate"))

fed_orig# A tibble: 904 × 10

year month day fedfunds_…¹ fedfu…² fedfu…³ fedfu…⁴ realg…⁵ unemp…⁶ infla…⁷

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 1954 7 1 NA NA NA 0.8 4.6 5.8 NA

2 1954 8 1 NA NA NA 1.22 NA 6 NA

3 1954 9 1 NA NA NA 1.06 NA 6.1 NA

4 1954 10 1 NA NA NA 0.85 8 5.7 NA

5 1954 11 1 NA NA NA 0.83 NA 5.3 NA

6 1954 12 1 NA NA NA 1.28 NA 5 NA

7 1955 1 1 NA NA NA 1.39 11.9 4.9 NA

8 1955 2 1 NA NA NA 1.29 NA 4.7 NA

9 1955 3 1 NA NA NA 1.35 NA 4.6 NA

10 1955 4 1 NA NA NA 1.43 6.7 4.7 NA

# … with 894 more rows, and abbreviated variable names ¹fedfunds_target,

# ²fedfunds_upper, ³fedfunds_lower, ⁴fedfunds_eff, ⁵realgdp_change,

# ⁶unemploy_rate, ⁷inflation_rate

# ℹ Use `print(n = ...)` to see more rowsBriefly describe the data

print(dfSummary(fed_orig, varnumbers = FALSE,

plain.ascii = FALSE,

style = "grid",

graph.magnif = 0.70,

valid.col = FALSE),

method = 'render',

table.classes = 'table-condensed')Data Frame Summary

fed_orig

Dimensions: 904 x 10Duplicates: 0

| Variable | Stats / Values | Freqs (% of Valid) | Graph | Missing | ||||

|---|---|---|---|---|---|---|---|---|

| year [numeric] |

|

64 distinct values | 0 (0.0%) | |||||

| month [numeric] |

|

12 distinct values | 0 (0.0%) | |||||

| day [numeric] |

|

29 distinct values | 0 (0.0%) | |||||

| fedfunds_target [numeric] |

|

63 distinct values | 442 (48.9%) | |||||

| fedfunds_upper [numeric] |

|

4 distinct values | 801 (88.6%) | |||||

| fedfunds_lower [numeric] |

|

4 distinct values | 801 (88.6%) | |||||

| fedfunds_eff [numeric] |

|

466 distinct values | 152 (16.8%) | |||||

| realgdp_change [numeric] |

|

113 distinct values | 654 (72.3%) | |||||

| unemploy_rate [numeric] |

|

71 distinct values | 152 (16.8%) | |||||

| inflation_rate [numeric] |

|

106 distinct values | 194 (21.5%) |

Generated by summarytools 1.0.1 (R version 4.2.1)

2022-08-28

Tidy Data (as needed)

There was just a little bit of tidying needed, to clean up the date.

fed<-fed_orig %>%

mutate(date=make_date(year,month,day)) %>%

select(-c(year,month,day))

fed# A tibble: 904 × 8

fedfunds_target fedfunds…¹ fedfu…² fedfu…³ realg…⁴ unemp…⁵ infla…⁶ date

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <date>

1 NA NA NA 0.8 4.6 5.8 NA 1954-07-01

2 NA NA NA 1.22 NA 6 NA 1954-08-01

3 NA NA NA 1.06 NA 6.1 NA 1954-09-01

4 NA NA NA 0.85 8 5.7 NA 1954-10-01

5 NA NA NA 0.83 NA 5.3 NA 1954-11-01

6 NA NA NA 1.28 NA 5 NA 1954-12-01

7 NA NA NA 1.39 11.9 4.9 NA 1955-01-01

8 NA NA NA 1.29 NA 4.7 NA 1955-02-01

9 NA NA NA 1.35 NA 4.6 NA 1955-03-01

10 NA NA NA 1.43 6.7 4.7 NA 1955-04-01

# … with 894 more rows, and abbreviated variable names ¹fedfunds_upper,

# ²fedfunds_lower, ³fedfunds_eff, ⁴realgdp_change, ⁵unemploy_rate,

# ⁶inflation_rate

# ℹ Use `print(n = ...)` to see more rowsTime Dependent Visualization

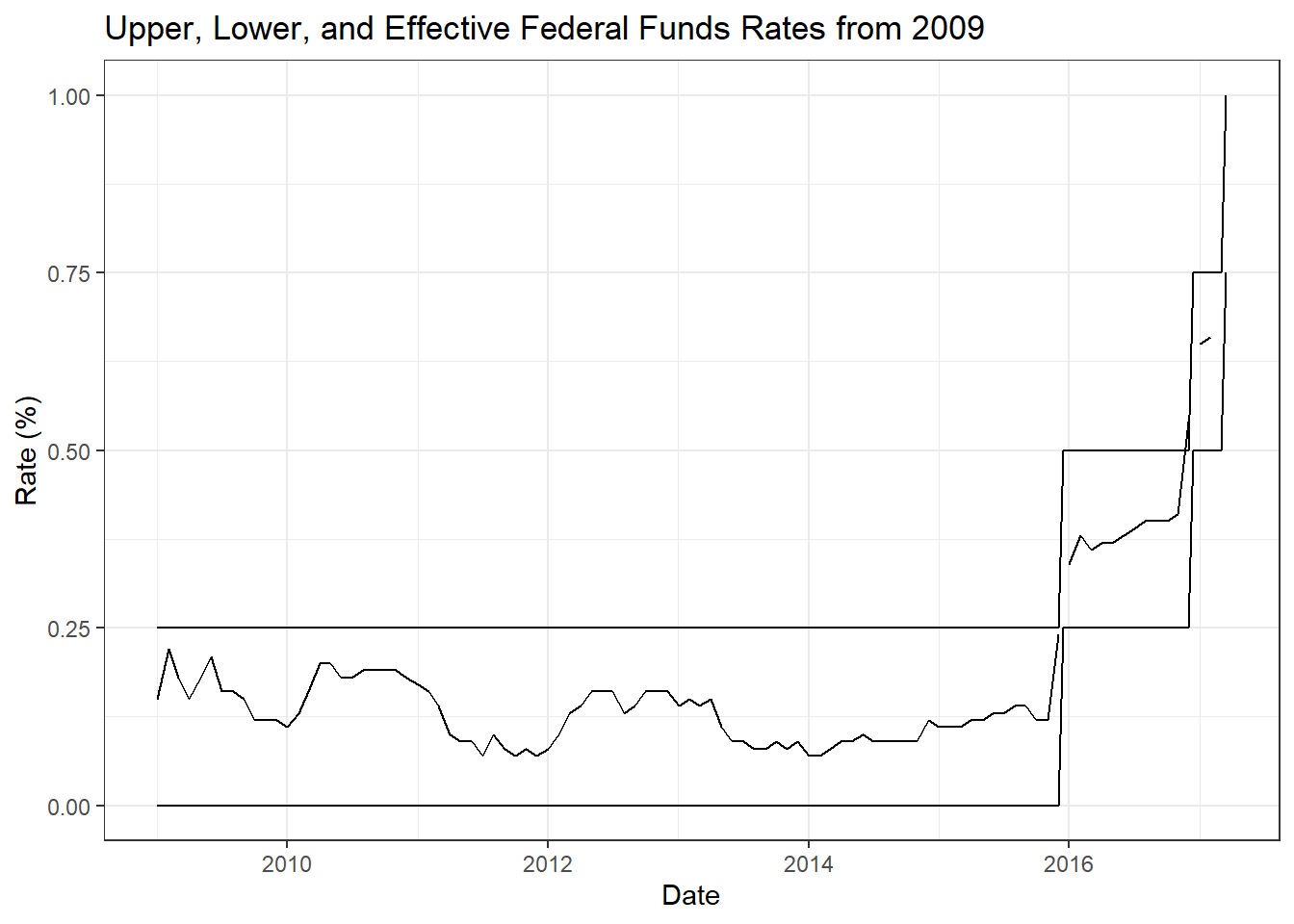

I was curious to analyze some of these macroeconomic indicators around the 2008 economic crisis, so I created another new data set that narrows the date range down to the five years before and after 2008.

fed_crisis<-fed %>%

filter(date>=ymd("2003-01-01")) %>%

filter(date<ymd("2013-01-01"))

fed_crisis# A tibble: 147 × 8

fedfunds_target fedfunds…¹ fedfu…² fedfu…³ realg…⁴ unemp…⁵ infla…⁶ date

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <date>

1 1.25 NA NA 1.24 2.1 5.8 1.9 2003-01-01

2 1.25 NA NA 1.26 NA 5.9 1.7 2003-02-01

3 1.25 NA NA 1.25 NA 5.9 1.7 2003-03-01

4 1.25 NA NA 1.26 3.8 6 1.5 2003-04-01

5 1.25 NA NA 1.26 NA 6.1 1.6 2003-05-01

6 1.25 NA NA 1.22 NA 6.3 1.5 2003-06-01

7 1 NA NA NA NA NA NA 2003-06-25

8 1 NA NA 1.01 6.9 6.2 1.5 2003-07-01

9 1 NA NA 1.03 NA 6.1 1.3 2003-08-01

10 1 NA NA 1.01 NA 6.1 1.2 2003-09-01

# … with 137 more rows, and abbreviated variable names ¹fedfunds_upper,

# ²fedfunds_lower, ³fedfunds_eff, ⁴realgdp_change, ⁵unemploy_rate,

# ⁶inflation_rate

# ℹ Use `print(n = ...)` to see more rowsI wanted to plot Inflation, Unemployment, and Effective Federal Funds Rate on top of each other for this time period (2003-2013). I was able to plot these, but I was not able to successfully create a legend that clearly identifies which one is which.

fed_crisis %>%

ggplot(aes(x=date)) +

geom_line(aes(y=unemploy_rate,color="maroon")) +

geom_line(aes(y=inflation_rate,color="blue")) +

geom_line(aes(y=fedfunds_eff,color="dark green")) +

expand_limits(y=0) +

theme_bw() +

labs(title="Unemployment, Inflation, and the Federal Funds Rate Around 2008",

x="Date",

y="Rate (%)")

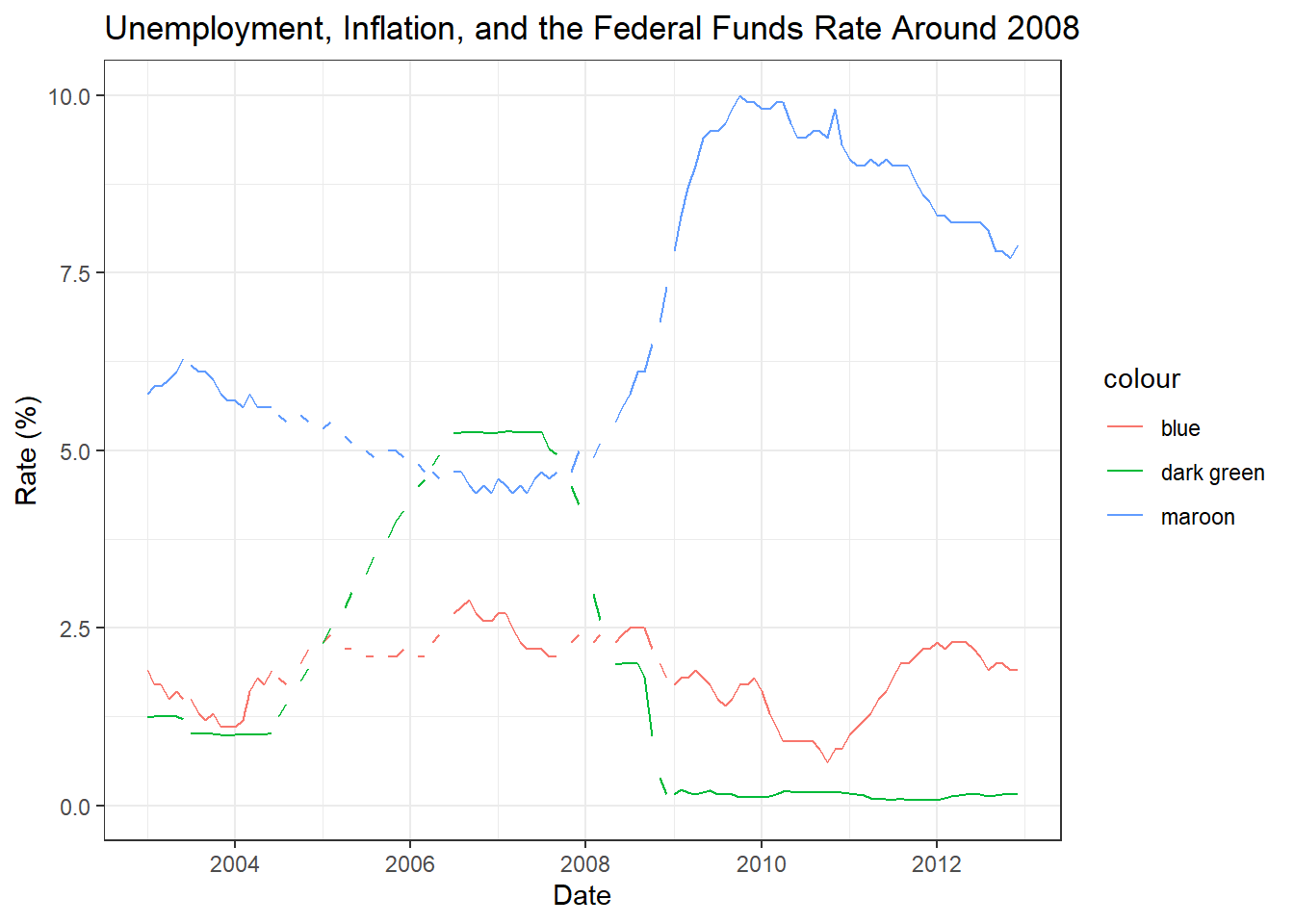

Visualizing Part-Whole Relationships

After the 2008 crisis, the Fed adjusted the way they dealt with the Federal Funds Rate, setting upper and lower targets for the effective rate. I wanted to plot these upper, lower, and effective rates from 2009 onwards. Once again, I was not sure how to create a legend for this graph; however, the upper-lower-effective nature of the data does make it somewhat intuitive to interpret, at least for someone familiar with the ideas of the data.

fed_post <- fed %>%

filter(date>=ymd("2009-01-01"))

fed_post# A tibble: 102 × 8

fedfunds_target fedfunds…¹ fedfu…² fedfu…³ realg…⁴ unemp…⁵ infla…⁶ date

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <date>

1 NA 0.25 0 0.15 -5.4 7.8 1.7 2009-01-01

2 NA 0.25 0 0.22 NA 8.3 1.8 2009-02-01

3 NA 0.25 0 0.18 NA 8.7 1.8 2009-03-01

4 NA 0.25 0 0.15 -0.5 9 1.9 2009-04-01

5 NA 0.25 0 0.18 NA 9.4 1.8 2009-05-01

6 NA 0.25 0 0.21 NA 9.5 1.7 2009-06-01

7 NA 0.25 0 0.16 1.3 9.5 1.5 2009-07-01

8 NA 0.25 0 0.16 NA 9.6 1.4 2009-08-01

9 NA 0.25 0 0.15 NA 9.8 1.5 2009-09-01

10 NA 0.25 0 0.12 3.9 10 1.7 2009-10-01

# … with 92 more rows, and abbreviated variable names ¹fedfunds_upper,

# ²fedfunds_lower, ³fedfunds_eff, ⁴realgdp_change, ⁵unemploy_rate,

# ⁶inflation_rate

# ℹ Use `print(n = ...)` to see more rowsfed_post %>%

ggplot(aes(x=date)) +

geom_line(aes(y=fedfunds_upper)) +

geom_line(aes(y=fedfunds_lower)) +

geom_line(aes(y=fedfunds_eff)) +

expand_limits(y=0) +

theme_bw() +

labs(title="Upper, Lower, and Effective Federal Funds Rates from 2009",

x="Date",

y="Rate (%)")