library(tidyverse)

library(ggplot2)

library(readxl)

library(lubridate)

library(here)

knitr::opts_chunk$set(echo = TRUE, warning=FALSE, message=FALSE)Challenge 6 Solutions

Challenge Overview

Today’s challenge is to:

- create at least one graph including time (evolution)

- try to make them “publication” ready (optional)

- Explain why you choose the specific graph type

- Create at least one graph depicting part-whole or flow relationships

- try to make them “publication” ready (optional)

- Explain why you choose the specific graph type

This data set runs from the first quarter of 2003 to the second quarter of 2021, and includes quarterly measures of the total amount of household debt associated with 6 different types of loans - mortgage,HE revolving, auto, credit card, student, and other - plus a total household debt including all 6 loan types. This is another fantastic macroeconomic data product from the New York Federal Reserve. See Challenge 4.

debt_orig<-here("posts","_data","debt_in_trillions.xlsx") %>%

read_excel()

debt_orig# A tibble: 74 × 8

`Year and Quarter` Mortgage HE Revolvin…¹ Auto …² Credi…³ Stude…⁴ Other Total

<chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 03:Q1 4.94 0.242 0.641 0.688 0.241 0.478 7.23

2 03:Q2 5.08 0.26 0.622 0.693 0.243 0.486 7.38

3 03:Q3 5.18 0.269 0.684 0.693 0.249 0.477 7.56

4 03:Q4 5.66 0.302 0.704 0.698 0.253 0.449 8.07

5 04:Q1 5.84 0.328 0.72 0.695 0.260 0.446 8.29

6 04:Q2 5.97 0.367 0.743 0.697 0.263 0.423 8.46

7 04:Q3 6.21 0.426 0.751 0.706 0.33 0.41 8.83

8 04:Q4 6.36 0.468 0.728 0.717 0.346 0.423 9.04

9 05:Q1 6.51 0.502 0.725 0.71 0.364 0.394 9.21

10 05:Q2 6.70 0.528 0.774 0.717 0.374 0.402 9.49

# … with 64 more rows, and abbreviated variable names ¹`HE Revolving`,

# ²`Auto Loan`, ³`Credit Card`, ⁴`Student Loan`debt<-debt_orig%>%

mutate(date = parse_date_time(`Year and Quarter`,

orders="yq"))Time Dependent Visualization

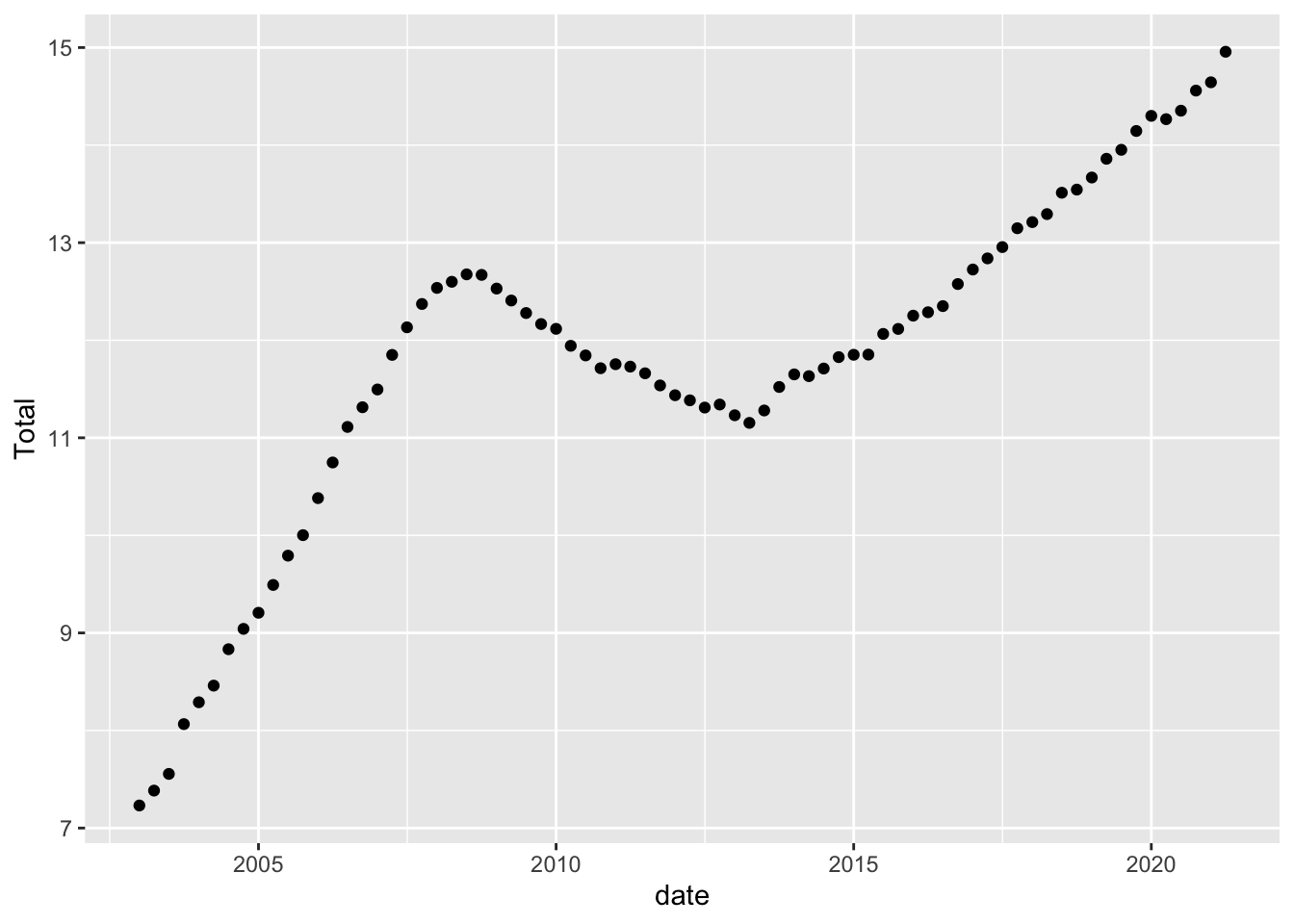

Lets look at how debt changes over time.

ggplot(debt, aes(x=date, y=Total)) +

geom_point()

ggplot(debt, aes(x=date, y=Total)) +

geom_point() +

geom_line()+

scale_y_continuous(limits=c(1,max(debt$Total)),labels = scales::label_number(suffix = " Trillion"))

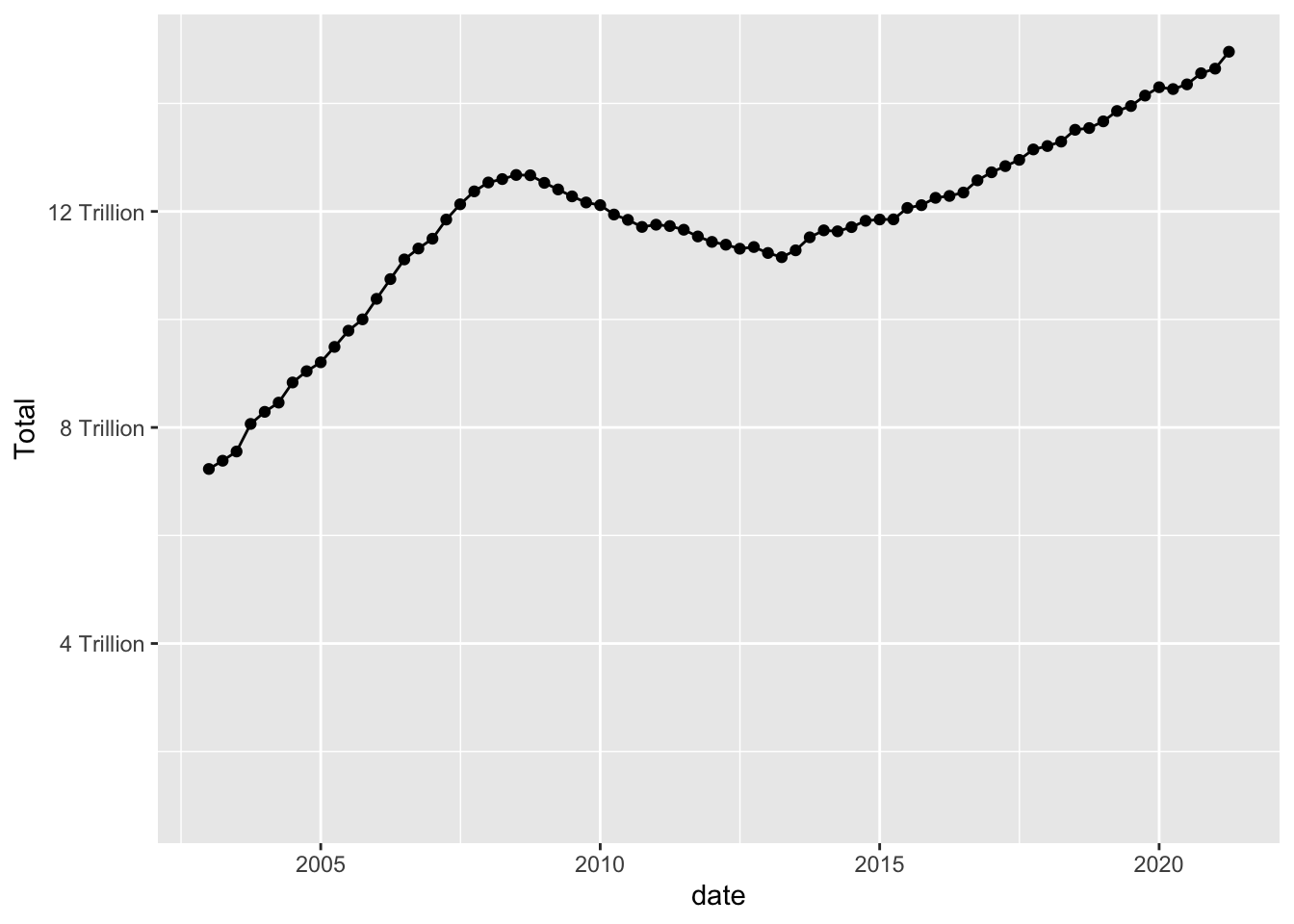

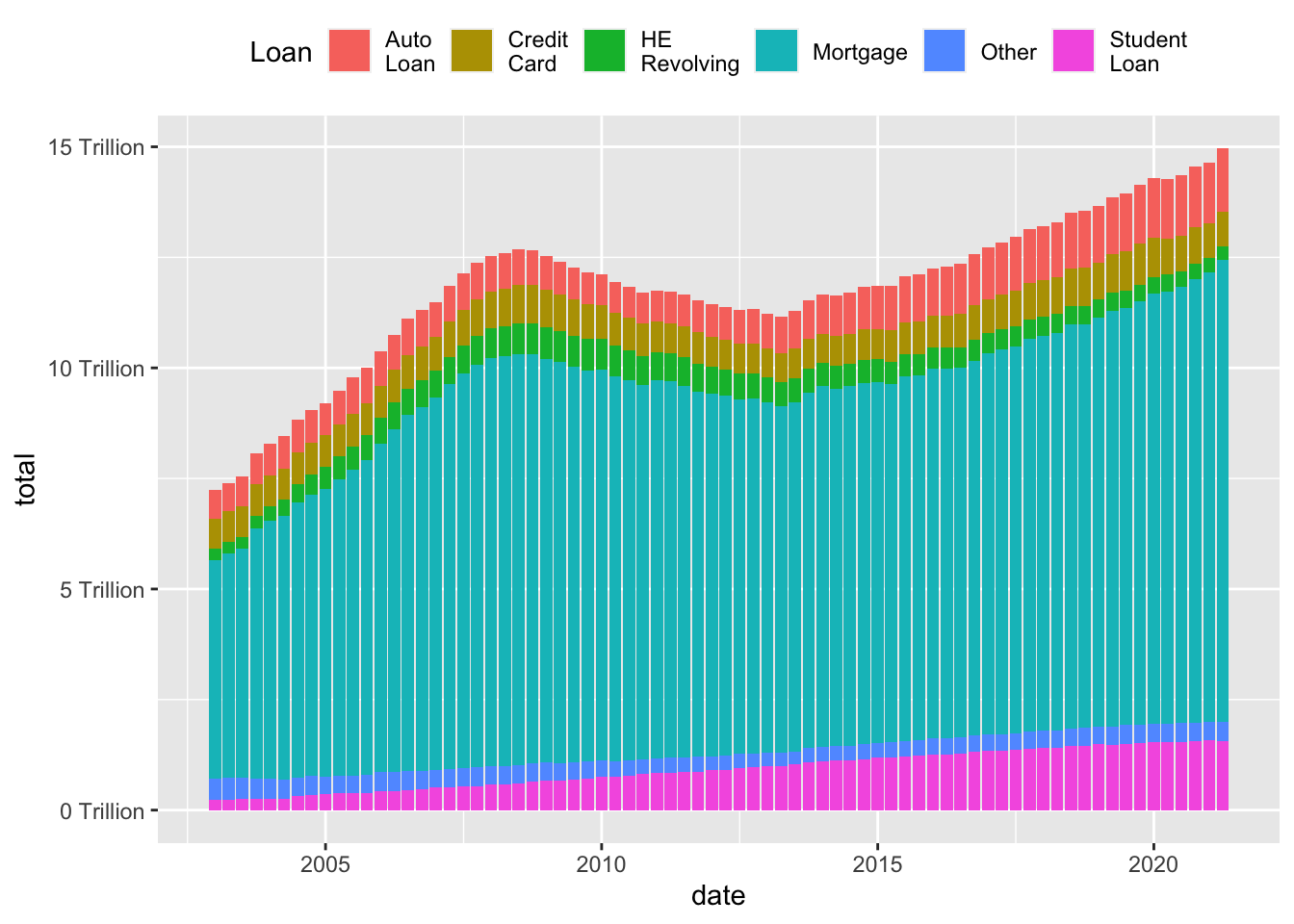

Visualizing Part-Whole Relationships

One thing to note is that it isn’t easy to include multiple lines on a single graph, that is because our data are not pivoted. Here is an example of how pivoting into tidy format makes things super easy.

debt_long<-debt%>%

pivot_longer(cols = Mortgage:Other,

names_to = "Loan",

values_to = "total")%>%

select(-Total)%>%

mutate(Loan = as.factor(Loan))

ggplot(debt_long, aes(x=date, y=total, color=Loan)) +

geom_point(size=.5) +

geom_line() +

theme(legend.position = "right") +

scale_y_continuous(labels = scales::label_number(suffix = " Trillion"))

ggplot(debt_long, aes(x=date, y=total, fill=Loan)) +

geom_bar(position="stack", stat="identity") +

scale_y_continuous(labels = scales::label_number(suffix = " Trillion"))+

theme(legend.position = "top") +

guides(fill = guide_legend(nrow = 1)) +

scale_fill_discrete(labels =

str_replace(levels(debt_long$Loan), " ", "\n"))

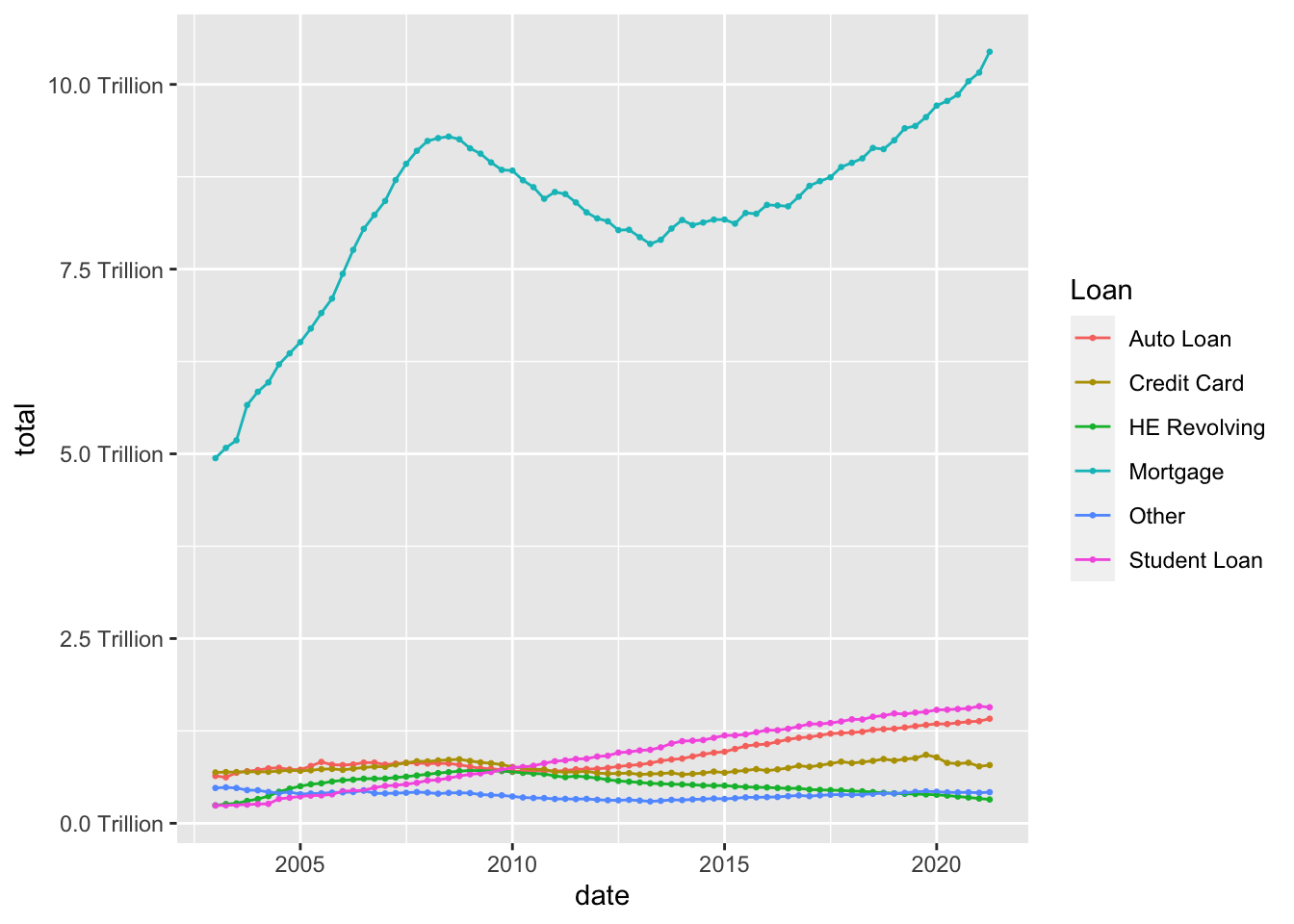

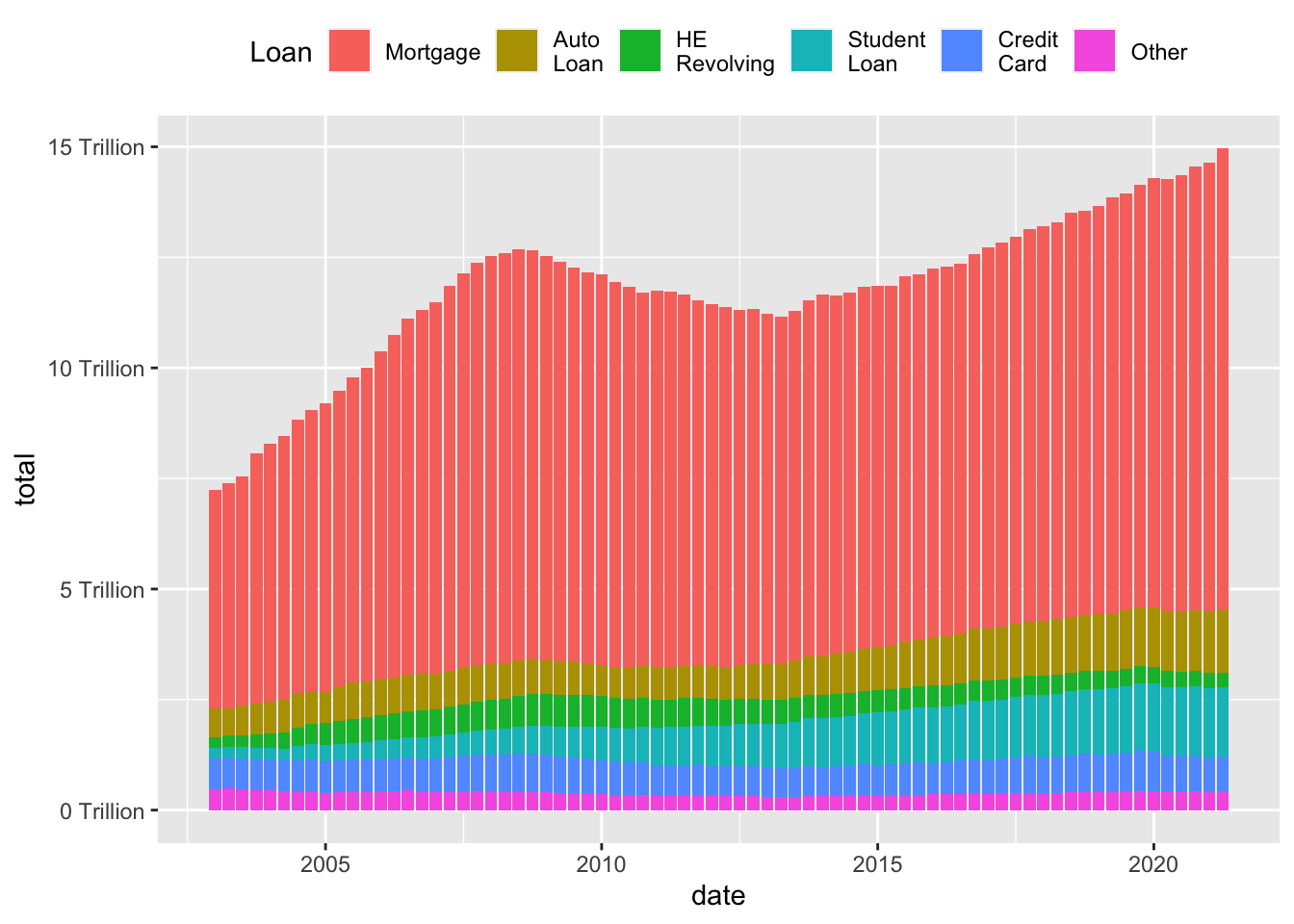

While the stacked chart might be easier to read in some respects, it is harder to follow individual trend lines. One solution is to reorder in order to preserve as much information as possible.

debt_long<-debt_long%>%

mutate(Loan = fct_relevel(Loan, "Mortgage",

"Auto Loan","HE Revolving", "Student Loan",

"Credit Card","Other"))

ggplot(debt_long, aes(x=date, y=total, fill=Loan)) +

geom_bar(position="stack", stat="identity") +

scale_y_continuous(labels = scales::label_number(suffix = " Trillion"))+

theme(legend.position = "top") +

guides(fill = guide_legend(nrow = 1)) +

scale_fill_discrete(labels=

str_replace(levels(debt_long$Loan), " ", "\n"))

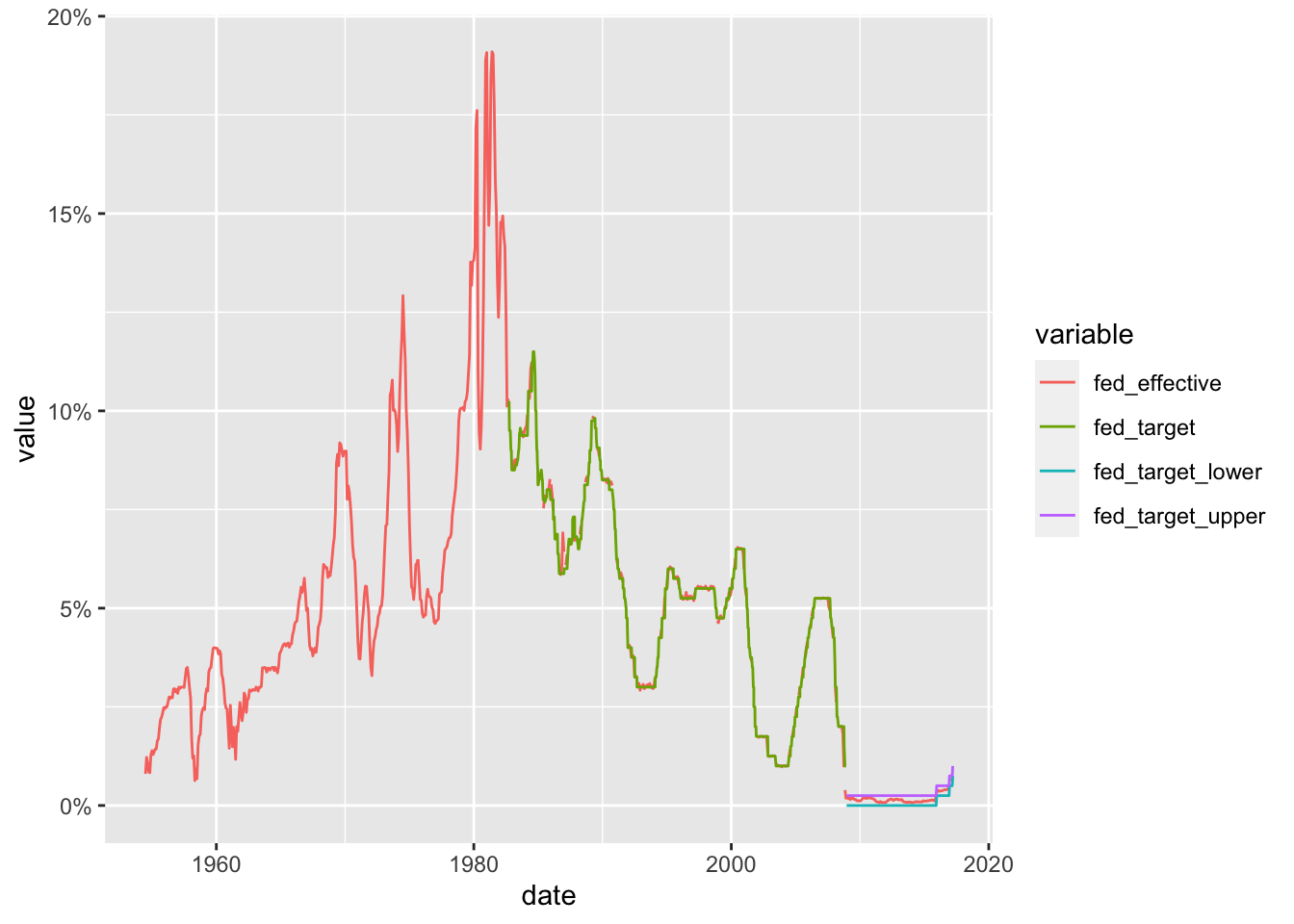

This data set runs from July 1954 to March 2017, and includes daily macroeconomic indicators related to the effective federal funds rate - or the interest rate at which banks lend money to each other in order to meet mandated reserve requirements. There are 7 variables besides the date: 4 values related to the federal funds rate (target, upper target, lower target, and effective), 3 are related macroeconomic indicators (inflation, GDP change, and unemployment rate.)

fed_rates_vars<-here("posts","_data","FedFundsRate.csv") %>%

read_csv(n_max = 1,

col_names = NULL)%>%

select(-c(X1:X3))%>%

unlist(.)

names(fed_rates_vars) <-c("fed_target", "fed_target_upper",

"fed_target_lower", "fed_effective",

"gdp_ch", "unemploy", "inflation")

fed_rates_orig<-here("posts","_data","FedFundsRate.csv") %>%

read_csv(skip=1,

col_names = c("Year", "Month", "Day",

names(fed_rates_vars)))

fed_rates<-fed_rates_orig%>%

mutate(date = make_date(Year, Month, Day))%>%

select(-c(Year, Month, Day))

fed_rates <- fed_rates%>%

pivot_longer(cols=-date,

names_to = "variable",

values_to = "value")

fed_rates# A tibble: 6,328 × 3

date variable value

<date> <chr> <dbl>

1 1954-07-01 fed_target NA

2 1954-07-01 fed_target_upper NA

3 1954-07-01 fed_target_lower NA

4 1954-07-01 fed_effective 0.8

5 1954-07-01 gdp_ch 4.6

6 1954-07-01 unemploy 5.8

7 1954-07-01 inflation NA

8 1954-08-01 fed_target NA

9 1954-08-01 fed_target_upper NA

10 1954-08-01 fed_target_lower NA

# … with 6,318 more rowsNow we can try to visualize the data over time, with care paid to missing data.

fed_rates%>%

filter(str_starts(variable, "fed"))%>%

ggplot(., aes(x=date, y=value, color=variable))+

geom_line()+

scale_y_continuous(labels = scales::label_percent(scale = 1))

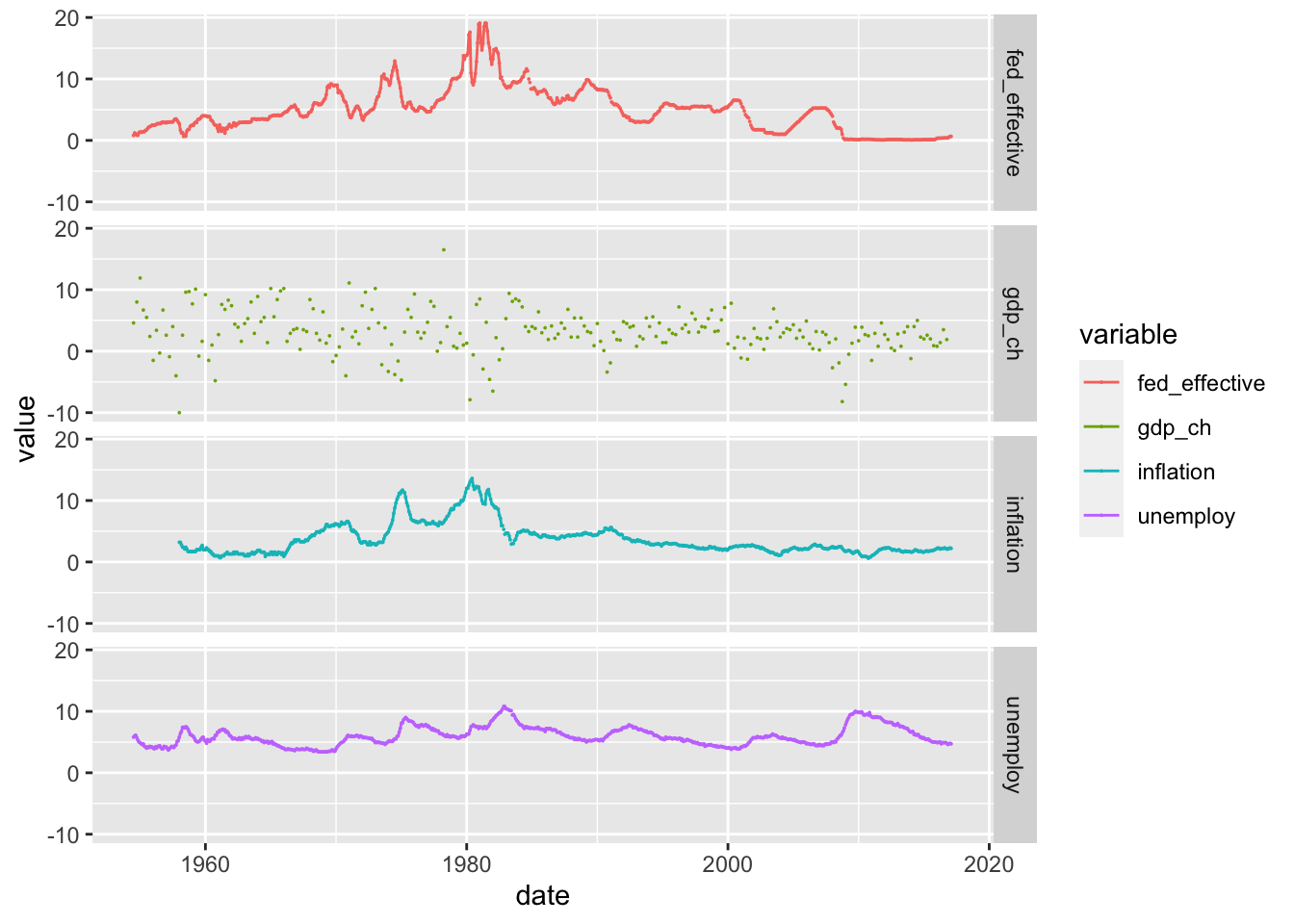

We can now see how closely the effective rate adheres to the target rate (and can see how the Fed changed the way it set it target rate around the time of the 2009 financial crash). Can we find out more by comparing the effective rate to one of the other macroeconomic indicators?

fed_rates%>%

filter(variable%in%c("fed_effective", "gdp_ch",

"unemploy", "inflation"))%>%

ggplot(., aes(x=date, y=value, color=variable))+

geom_point(size=0)+

geom_line()+

facet_grid(rows = vars(variable))

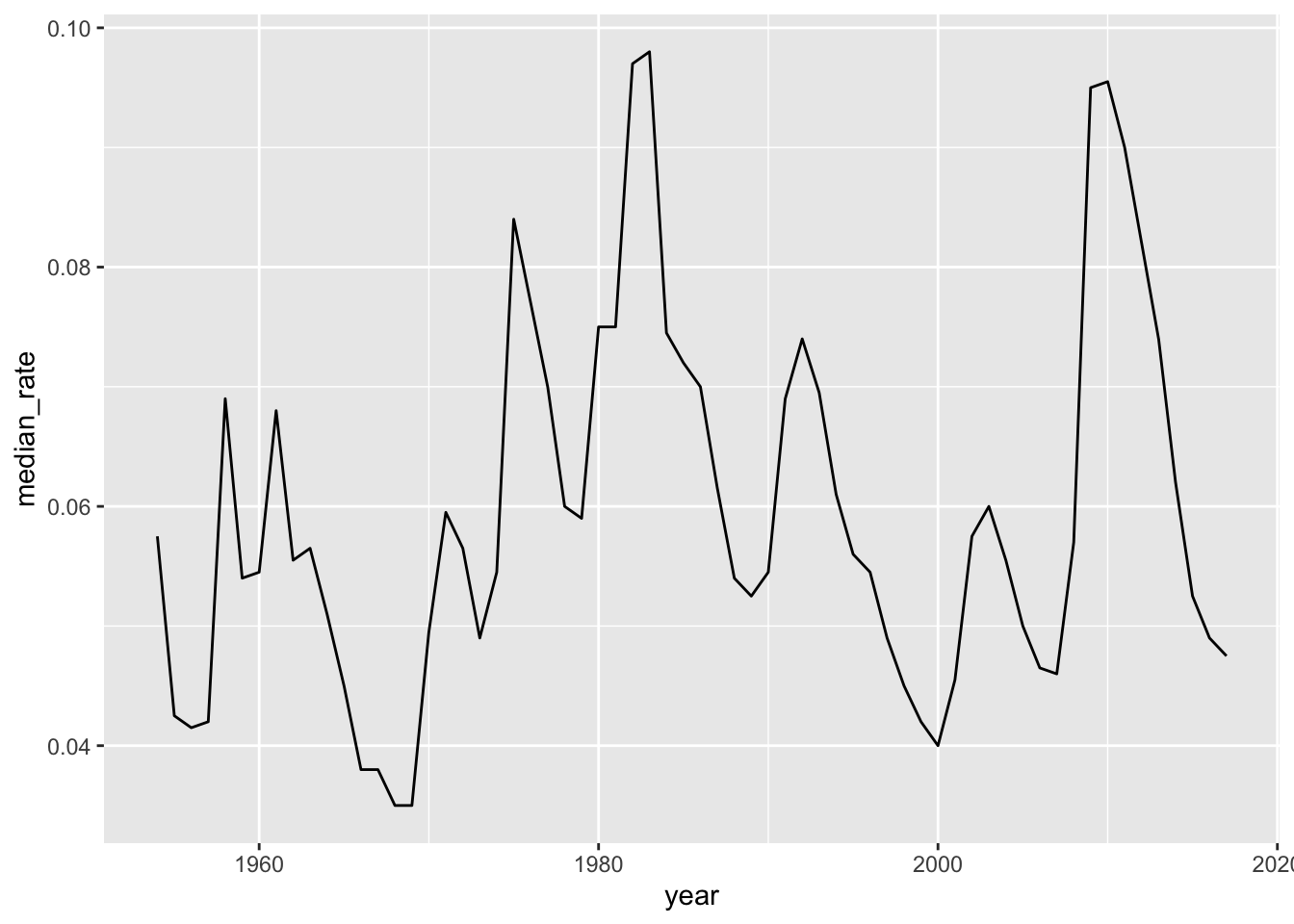

year_unemploy <- fed_rates %>%

pivot_wider(names_from = variable, values_from = value) %>%

mutate(year=year(date)) %>%

group_by(year) %>%

summarise(median_rate=median(unemploy,na.rm=T)/100) %>%

ungroup()

year_unemploy# A tibble: 64 × 2

year median_rate

<dbl> <dbl>

1 1954 0.0575

2 1955 0.0425

3 1956 0.0415

4 1957 0.042

5 1958 0.069

6 1959 0.054

7 1960 0.0545

8 1961 0.068

9 1962 0.0555

10 1963 0.0565

# … with 54 more rowsyear_unemploy %>%

ggplot(aes(year,median_rate))+

geom_line()

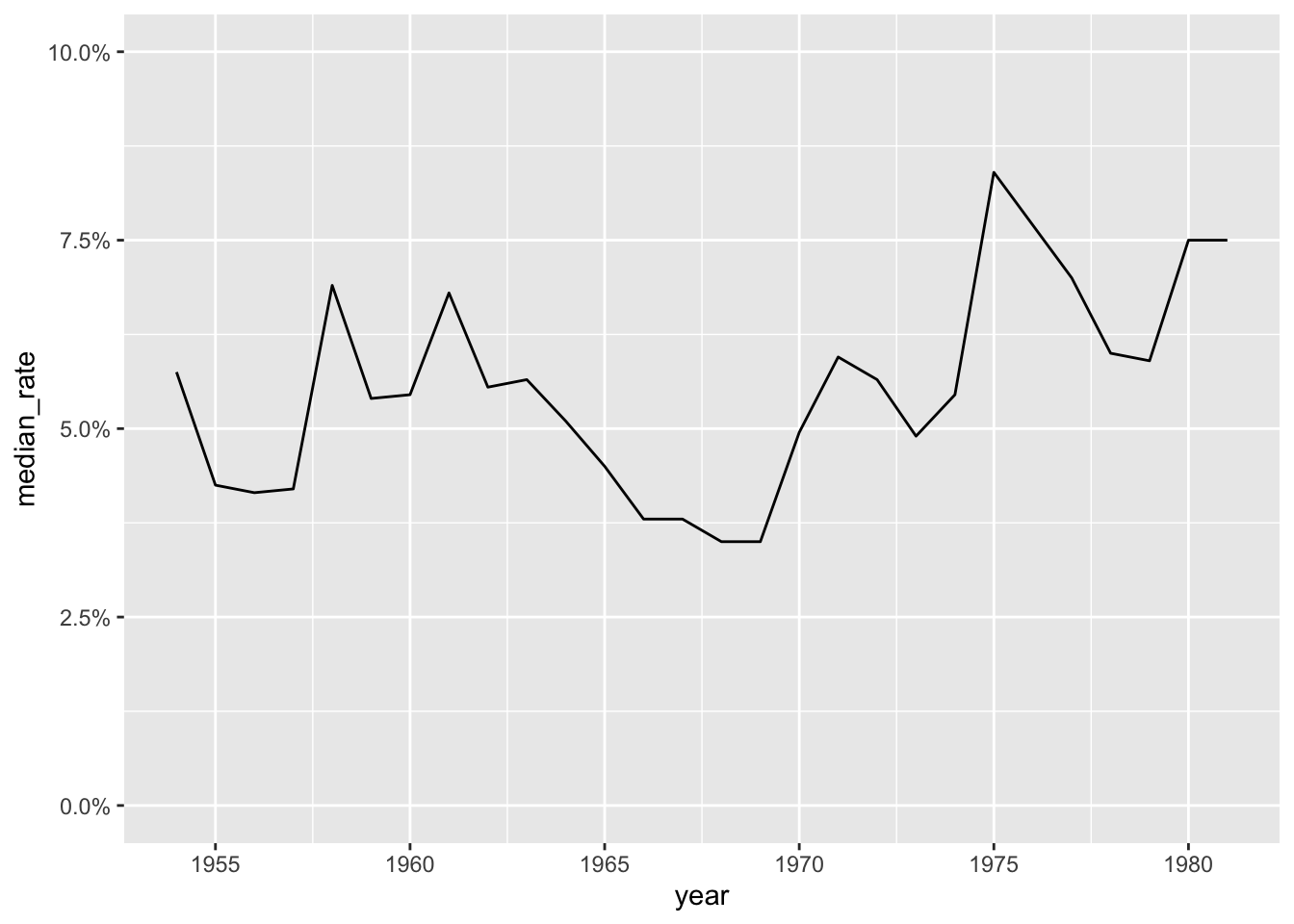

year_unemploy %>%

filter(year<=1981) %>%

ggplot(aes(year,median_rate))+

geom_line()+

scale_y_continuous(labels=scales::percent_format(),limits=c(0,.1))+

scale_x_continuous(breaks=seq(1955,1980,5))

labs(x="year",y="median unemployment rate")$x

[1] "year"

$y

[1] "median unemployment rate"

attr(,"class")

[1] "labels"income_brackets <- c(i1 = "Under $15,000",

i2 = "$15,000 to $24,999",

i3 = "$25,000 to $34,999",

i4= "$35,000 to $49,999",

i5 = "$50,000 to $74,999",

i6 = "$75,000 to $99,999",

i7 = "$100,000 to $149,999",

i8 = "$150,000 to $199,999",

i9 = "$200,000 and over")

ushh_orig <- here("posts","_data","USA Households by Total Money Income, Race, and Hispanic Origin of Householder 1967 to 2019.xlsx") %>%

read_excel(skip=5,

n_max = 352,

col_names = c("year", "hholds", "del",

str_c("income",1:9,sep="_i"),

"median_inc", "median_se",

"mean_inc","mean_se"))%>%

select(-del)

ushh_orig # A tibble: 352 × 15

year hholds incom…¹ incom…² incom…³ incom…⁴ incom…⁵ incom…⁶ incom…⁷ incom…⁸

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 ALL R… <NA> NA NA NA NA NA NA NA NA

2 2019 128451 9.1 8 8.3 11.7 16.5 12.3 15.5 8.3

3 2018 128579 10.1 8.8 8.7 12 17 12.5 15 7.2

4 2017 2 127669 10 9.1 9.2 12 16.4 12.4 14.7 7.3

5 2017 127586 10.1 9.1 9.2 11.9 16.3 12.6 14.8 7.5

6 2016 126224 10.4 9 9.2 12.3 16.7 12.2 15 7.2

7 2015 125819 10.6 10 9.6 12.1 16.1 12.4 14.9 7.1

8 2014 124587 11.4 10.5 9.6 12.6 16.4 12.1 14 6.6

9 2013 3 123931 11.4 10.3 9.5 12.5 16.8 12 13.9 6.7

10 2013 4 122952 11.3 10.4 9.7 13.1 17 12.5 13.6 6.3

# … with 342 more rows, 5 more variables: income_i9 <dbl>, median_inc <dbl>,

# median_se <dbl>, mean_inc <chr>, mean_se <chr>, and abbreviated variable

# names ¹income_i1, ²income_i2, ³income_i3, ⁴income_i4, ⁵income_i5,

# ⁶income_i6, ⁷income_i7, ⁸income_i8ushh_id<-ushh_orig%>%

mutate(identity = case_when(

str_detect(year, "[[:alpha:]]") ~ year,

TRUE ~ NA_character_

))%>%

fill(identity)%>%

filter(!str_detect(year, "[[:alpha:]]"))

ushh_id<-ushh_id%>%

separate(year, into=c("year", "delete"), sep=" ")%>%

mutate(identity = str_remove(identity, " [0-9]+"),

across(any_of(c("hholds", "mean_inc", "mean_se", "year")),

as.numeric))%>%

select(-delete)

ushh_id# A tibble: 340 × 16

year hholds income…¹ incom…² incom…³ incom…⁴ incom…⁵ incom…⁶ incom…⁷ incom…⁸

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 2019 128451 9.1 8 8.3 11.7 16.5 12.3 15.5 8.3

2 2018 128579 10.1 8.8 8.7 12 17 12.5 15 7.2

3 2017 127669 10 9.1 9.2 12 16.4 12.4 14.7 7.3

4 2017 127586 10.1 9.1 9.2 11.9 16.3 12.6 14.8 7.5

5 2016 126224 10.4 9 9.2 12.3 16.7 12.2 15 7.2

6 2015 125819 10.6 10 9.6 12.1 16.1 12.4 14.9 7.1

7 2014 124587 11.4 10.5 9.6 12.6 16.4 12.1 14 6.6

8 2013 123931 11.4 10.3 9.5 12.5 16.8 12 13.9 6.7

9 2013 122952 11.3 10.4 9.7 13.1 17 12.5 13.6 6.3

10 2012 122459 11.4 10.6 10.1 12.5 17.4 12 13.9 6.3

# … with 330 more rows, 6 more variables: income_i9 <dbl>, median_inc <dbl>,

# median_se <dbl>, mean_inc <dbl>, mean_se <dbl>, identity <chr>, and

# abbreviated variable names ¹income_i1, ²income_i2, ³income_i3, ⁴income_i4,

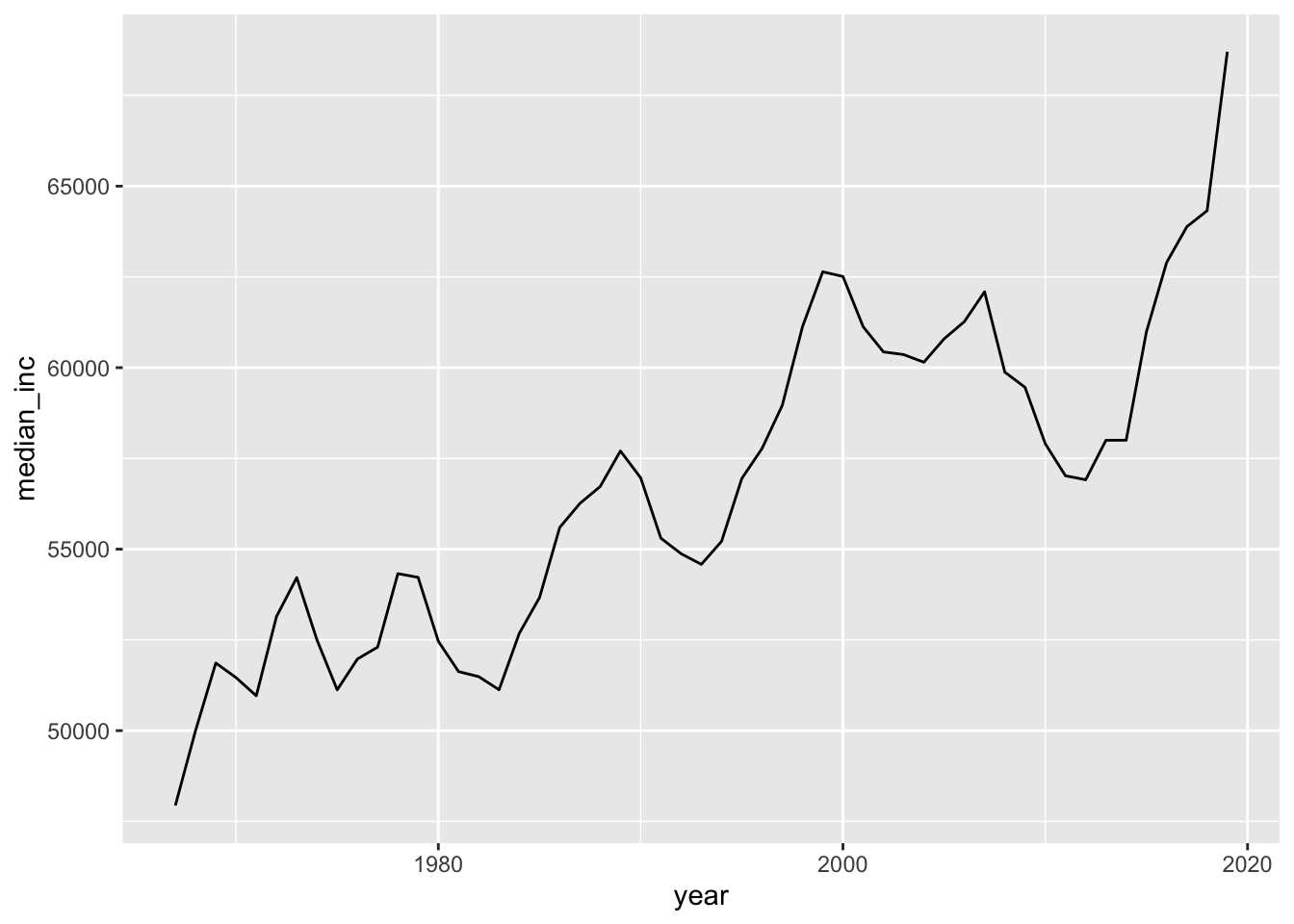

# ⁵income_i5, ⁶income_i6, ⁷income_i7, ⁸income_i8ushh <-ushh_id%>%

mutate(gp_identity = case_when(

identity %in% c("BLACK", "BLACK ALONE") ~ "gp_black",

identity %in% c("ASIAN ALONE OR IN COMBINATION",

"ASIAN AND PACIFIC ISLANDER") ~ "gp_asian",

identity %in% c("WHITE, NOT HISPANIC",

"WHITE ALONE, NOT HISPANIC") ~ "gp_white",

identity %in% c("HISPANIC (ANY RACE)") ~ "gp_hisp",

identity %in% c("ALL RACES") ~ "gp_all"

))%>%

filter(!is.na(gp_identity))%>%

group_by(year, gp_identity)%>%

summarise(across(c(starts_with("inc"),starts_with("me"),

"hholds"),

~median(.x, na.rm=TRUE)))%>% # sort of cheating - getting median of a median?

ungroup()ushh %>%

filter(gp_identity=="gp_all") %>%

ggplot(aes(year,median_inc))+

geom_line()

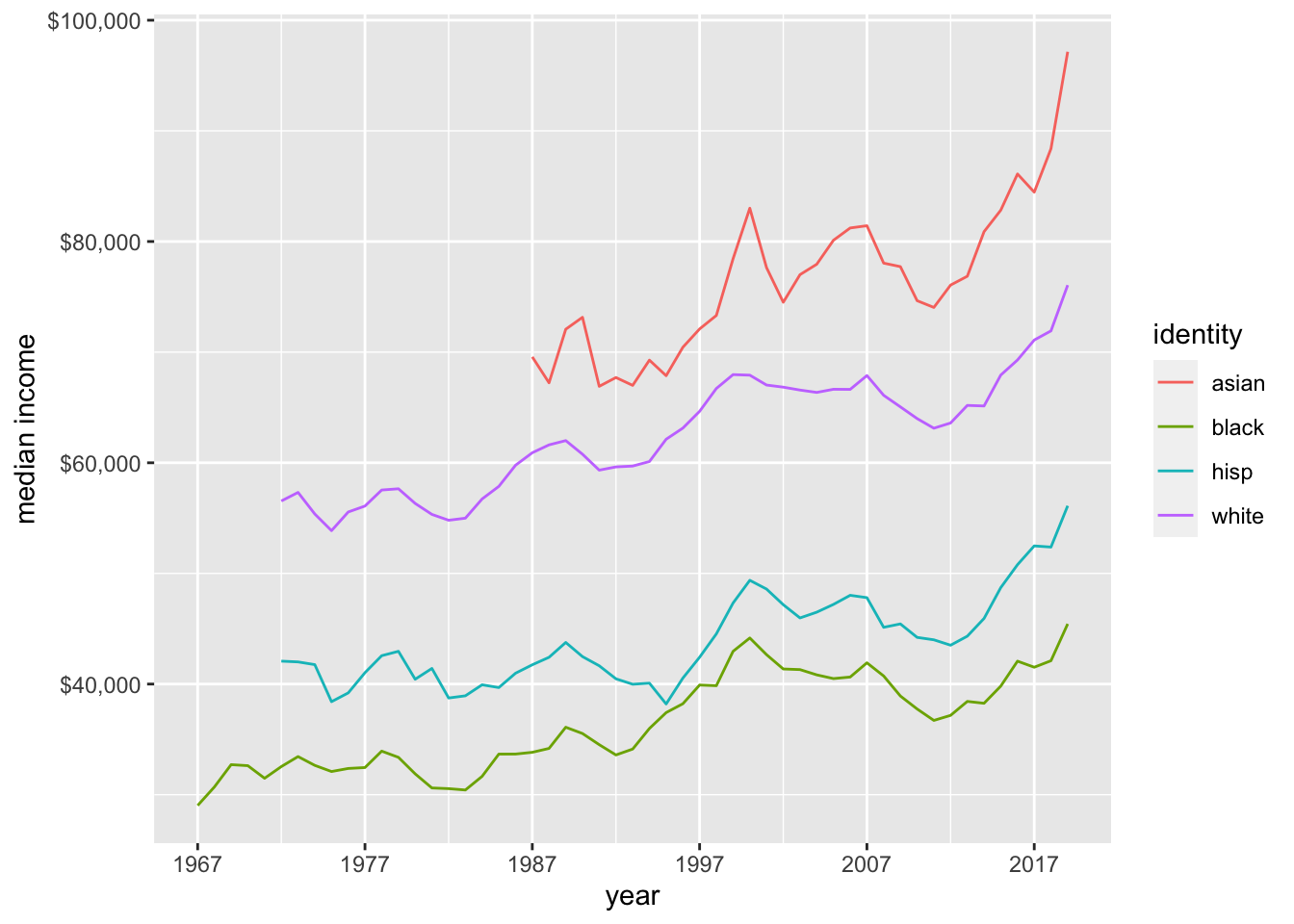

ushh %>%

filter(gp_identity!="gp_all") %>%

mutate(gp_identity=str_remove(gp_identity,"gp_"))%>%

ggplot(aes(year,median_inc,col=gp_identity))+

geom_line()+

scale_x_continuous(limits=c(min(ushh$year),max(ushh$year)),

breaks=seq(min(ushh$year),max(ushh$year),by=10))+

scale_y_continuous(labels = scales::dollar_format())+

scale_color_discrete(name="identity")+

labs(x="year",y="median income")

bookings_orig<- here("posts","_data","hotel_bookings.csv") %>%

read_csv()

bookings<-bookings_orig%>%

mutate(date_arrival = str_c(arrival_date_day_of_month,

arrival_date_month,

arrival_date_year, sep="/"),

date_arrival = dmy(date_arrival))%>%

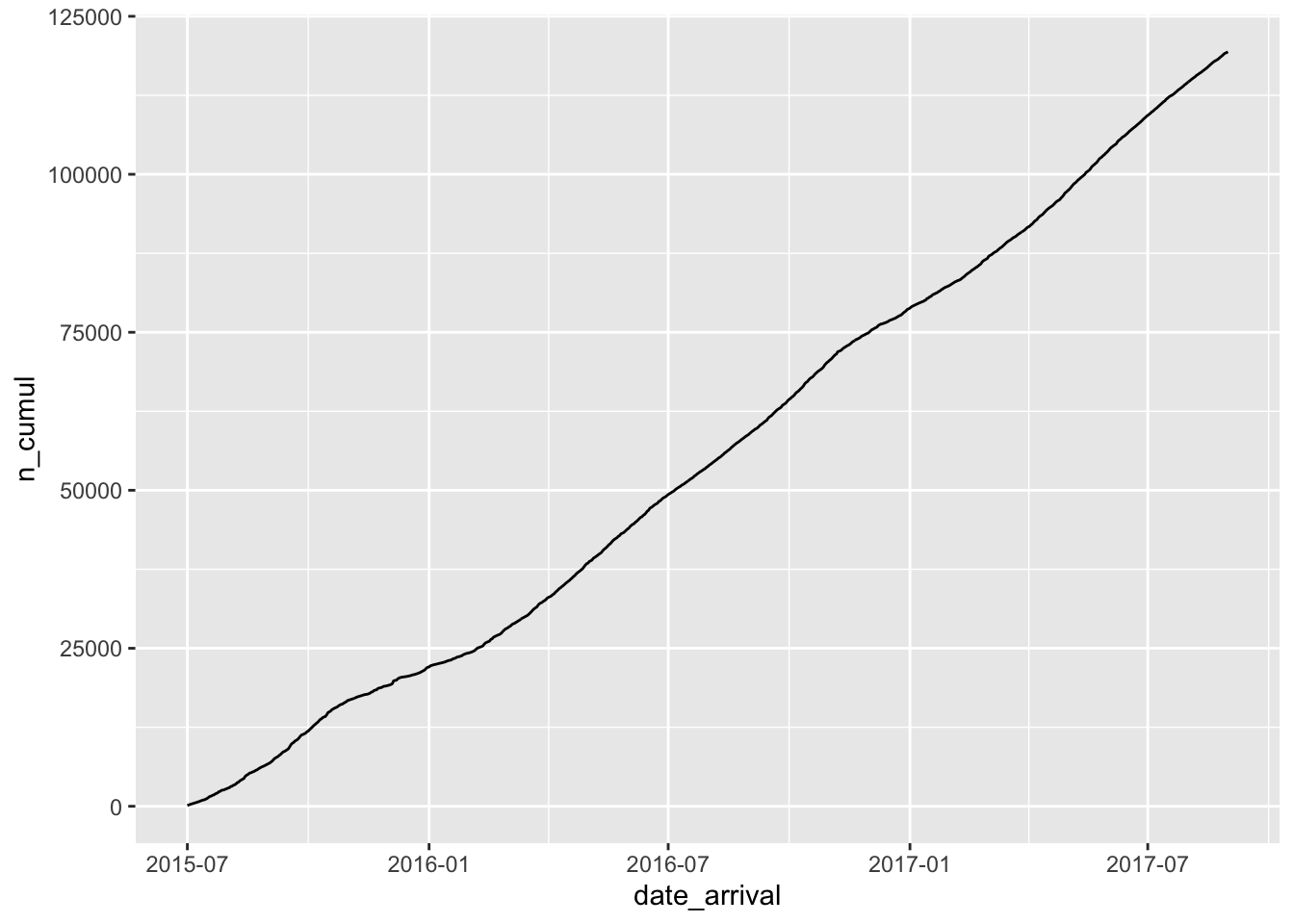

select(-starts_with("arrival"))bookings_cumul <- bookings %>%

group_by(date_arrival) %>%

summarise(n=n()) %>%

ungroup() %>%

mutate(n_cumul=cumsum(n))

bookings_cumul# A tibble: 793 × 3

date_arrival n n_cumul

<date> <int> <int>

1 2015-07-01 122 122

2 2015-07-02 93 215

3 2015-07-03 56 271

4 2015-07-04 88 359

5 2015-07-05 53 412

6 2015-07-06 75 487

7 2015-07-07 54 541

8 2015-07-08 69 610

9 2015-07-09 80 690

10 2015-07-10 51 741

# … with 783 more rowsggplot(bookings_cumul, aes(date_arrival,n_cumul))+

geom_line()

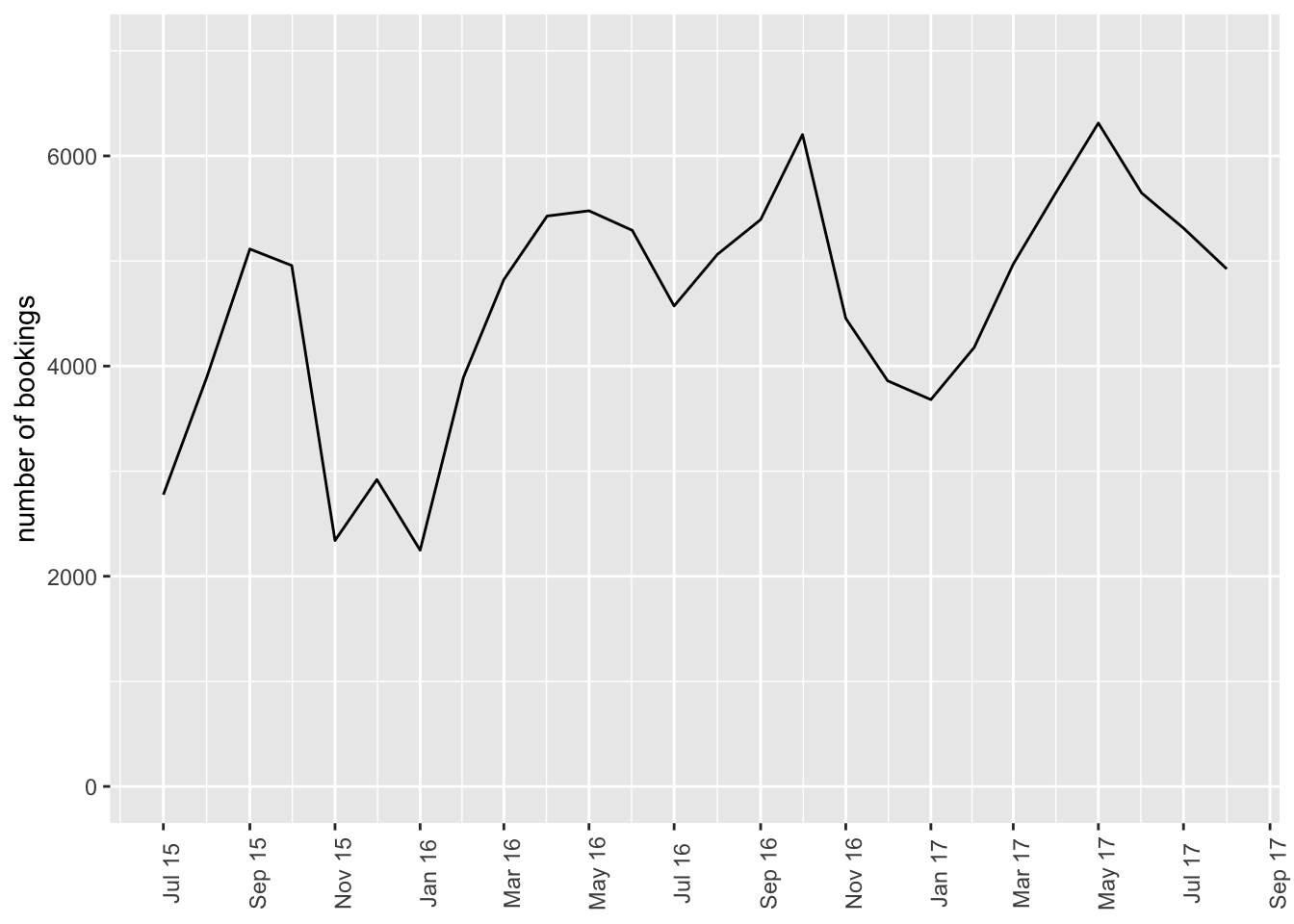

bookings_month_n <- bookings %>%

mutate(month=floor_date(date_arrival,unit="month")) %>%

group_by(month) %>%

summarise(n=n()) %>%

ungroup()

bookings_month_n# A tibble: 26 × 2

month n

<date> <int>

1 2015-07-01 2776

2 2015-08-01 3889

3 2015-09-01 5114

4 2015-10-01 4957

5 2015-11-01 2340

6 2015-12-01 2920

7 2016-01-01 2248

8 2016-02-01 3891

9 2016-03-01 4824

10 2016-04-01 5428

# … with 16 more rowsbookings_month_n %>%

ggplot(aes(month,n))+

geom_line()+

scale_x_date(NULL, date_labels = "%b %y",breaks="2 months")+

scale_y_continuous(limits=c(0,7000))+

labs(x="date",y="number of bookings")+

theme(axis.text.x=element_text(angle=90))

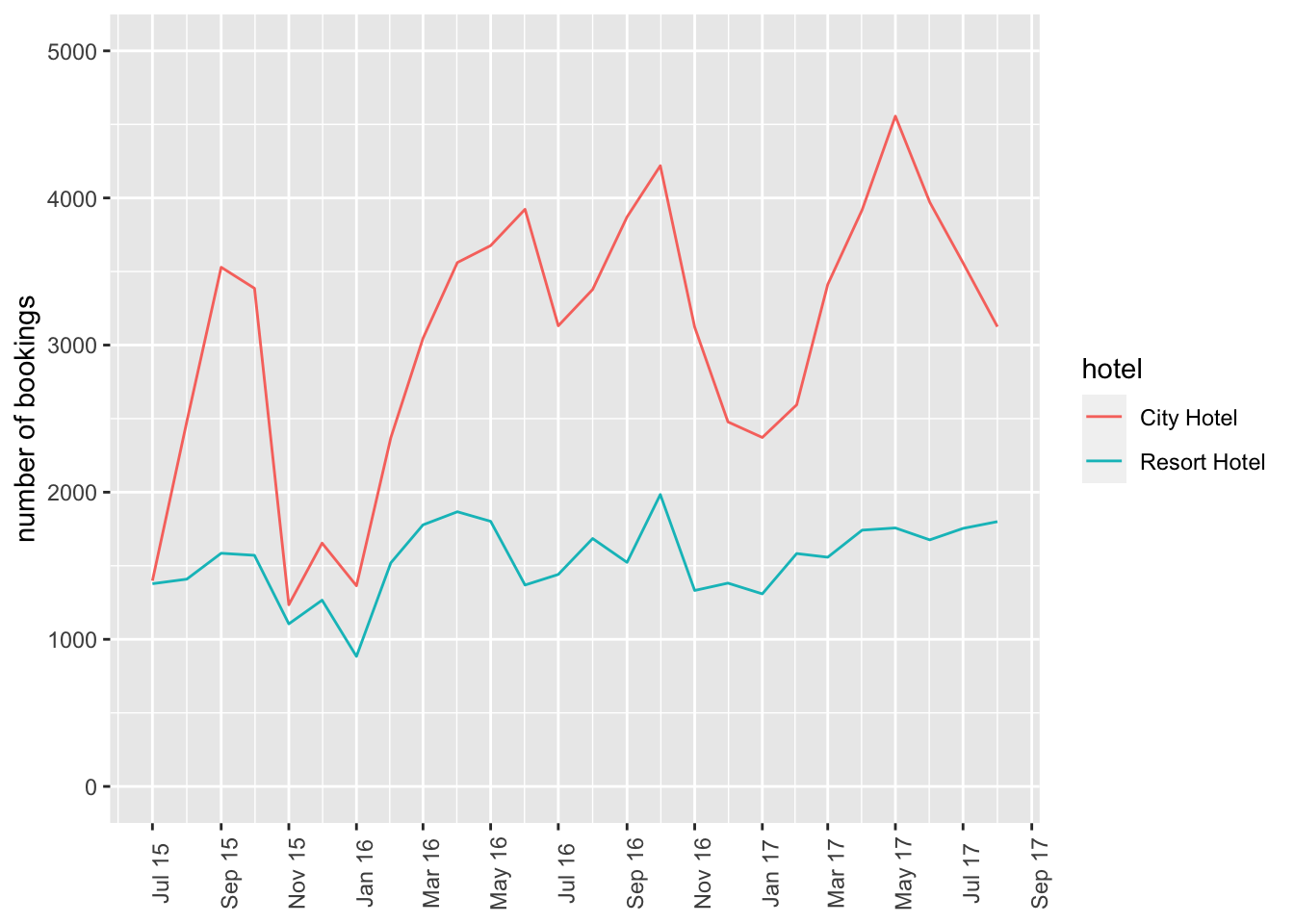

bookings_month_hotel_n <- bookings %>%

mutate(month=floor_date(date_arrival,unit="month")) %>%

group_by(month, hotel) %>%

summarise(n=n()) %>%

ungroup()

bookings_month_hotel_n# A tibble: 52 × 3

month hotel n

<date> <chr> <int>

1 2015-07-01 City Hotel 1398

2 2015-07-01 Resort Hotel 1378

3 2015-08-01 City Hotel 2480

4 2015-08-01 Resort Hotel 1409

5 2015-09-01 City Hotel 3529

6 2015-09-01 Resort Hotel 1585

7 2015-10-01 City Hotel 3386

8 2015-10-01 Resort Hotel 1571

9 2015-11-01 City Hotel 1235

10 2015-11-01 Resort Hotel 1105

# … with 42 more rowsbookings_month_hotel_n %>%

ggplot(aes(month,n,col=hotel))+

geom_line()+

scale_x_date(NULL, date_labels = "%b %y",breaks="2 months")+

scale_y_continuous(limits=c(0,5000))+

labs(x="date",y="number of bookings")+

theme(axis.text.x=element_text(angle=90))